Dr Subramanian Swamy, senior leader of the Bharatiya Janata Party (BJP) on Friday called for abolition of income tax and levy only one tax, the goods and service tax (GST) at 8% after bringing black money stashed abroad .He was speaking at a book release event organised by Moneylife Foundation and BSE in Mumbai.

Dr Swamy said, “For black money, there are two symptoms. One is flow and second is stock of black money. Prof Vaidyanathan’s estimate of Indian black money stock is Rs65 lakh crore. Illicit wealth stashed in tax havens abroad by Indians should be declared as national wealth and directed to be transferred to India under the United Nations’ Convention on Corruption.”

The International Convention Hall of BSE where the programme took place was filled to the capacity. The attendees included many eminent lawyers, chartered accountants and senior consultants as well.

“Black money has become a national security threat, corroding the country. The new age thinking that ‘money is everything’ is destroying the economy, that, money is not an index of social wellbeing”, Dr Swamy added.

He says, How much time did they take for Hosni Mubarak’s accounts to be seized? They took seven months. Same thing with Gadhafi. In case of Marcos, it took a year and a half and that was 1991-92. Things have become much tougher because of terrorist financing and tax havens, and two countries US and Germany are very sensitive to this. Therefore, I think we should not go for a system where we are lenient to those who broke the law. In India, we appear to be lenient to those who break the law to the extent that those who adhere to the law are found to be silly. It is imperative that India’s black money be brought back using the United Nations’ Convention on Corruption and a big chunk of it should go into savings and investment in the Indian economy.”

While elaborating on how the black money can be used, Dr Swamy said, corruption had affected the economy, politics and national security. “Apart from bringing back the black money we need to prevent its creation. Abolishing participatory notes (P-Notes), personal income tax (I-T) and registration charges for real estate is one of the ways to curb creation of black money,” he added.

Dr Swamy says, “Even today, the tax rates, in my opinion, are unacceptably high. We have a need to have a much higher savings and if you abolish income tax, there would less paperwork, which is there due to the exemptions. If you abolish the income tax, then you begin the new process where fresh generation of black money is going to be discouraged as a consequence.”

According to the former cabinet minister, some of the black money is sent abroad, while some kept here in India and spent on buying and developing land, especially for building luxurious houses with Italian marble and luxury items. About 75% of our investment is allocated for luxury industry. Another way to spend black money was through P-Notes, where money deposited abroad via hawala route is brought back to as P-Notes and invested in the stock markets. This got boost with the Mauritius treaty and much more money sent abroad through hawala came back to India after this.

Black money or kala dhan is a topic that has elicited much debate in recent times. The debate has been mostly marked by mud-slinging and name-calling and the discussions that have ensued often have no basis in fact. While most people have a hazy notion of black money, only a few understand it in its entirety.

Few years ago, the BJP leader had claimed that “black money is no more in Swiss banks”. However, no one believed him at that time.

The BJP has decided to mark 8th November, the first anniversary of the Union government’s decision to demonetise high value currency notes, as ‘anti-black money day’ across the country. The BJP’s move comes as 18 Opposition political parties had announced their own programme of marking the day as a “black day” terming the decision to demonetise as “ill-conceived and hasty”.

Commenting on this, Dr Swamy says, “During demonetization, we should have printed more Rs100 notes. On 8th November what the Prime Minister should announce is mission ‘Bring back black money’ over the next year. We should continue to mobilise our resources like from the auction for spectrum, and coal blocks. By abolishing income tax, we can reduce black money by almost 50% and then people will not have to stand in Qs”.

In 2015, the National Democratic Alliance (NDA) government set up a Special Task Force to unearth black money.

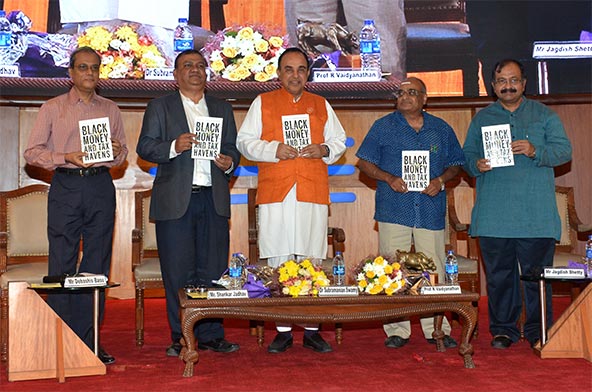

Earlier, Dr Swamy released “Black Money & Tax Havens”, a book by Prof R Vaidyanathan.

According to Prof Vaidyanathan, estimated black money in India could be 10% to 20% of our gross domestic product (GDP) or about Rs15 lakh crore, considering our GDP of Rs150 lakh crore for 2016-17. “Indian money in tax havens across the world could be about Rs65 lakh crore. The issue of tax havens is perhaps even more misunderstood. Most people fail to see the connection between tax havens and black money,” he said.

In his book “Black Money and Tax Havens”, Prof Vaidyanathan provides the reader with a brief overview of black money—its generation, its estimates and how and why it is spirited away to tax havens. He also lays bare the danger that is posed to world financial wellbeing because of the lack of political will to tackle them.