Origins

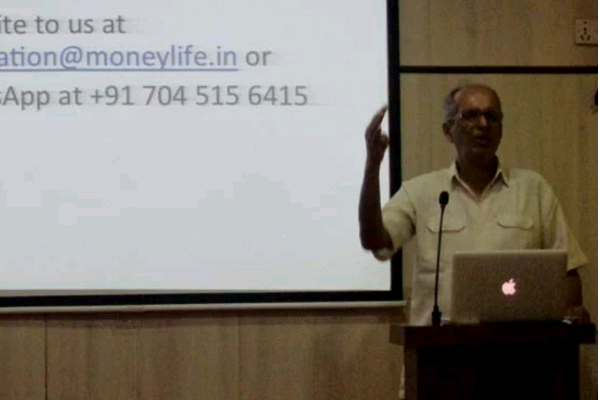

Moneylife Foundation, launched on 6th February 2010, is a non-profit organisation registered with the Charity Commissioner of Mumbai. The Foundation is engaged in spreading financial literacy, consumer awareness and advocacy and works towards safe and fair market practices through workshops, round table meetings, white papers, research, awareness campaigns, grievance redressal, counselling, petitions etc. We take pride in being fiercely independent, non-partisan and always pro-consumer.

Moneylife Foundation is one of the fastest growing and foremost NGOs for consumers and investors. As a recognition of our efforts, we received the 10th M.R. Pai Memorial Award in September 2014 for our outstanding work.

Mission

Our mission is to make savers & investors financially aware, empower consumers to fight for their rights and citizens to think and act responsibly. We want be the voice to those of us who work hard, earn, save but don t have a say in the decisions that affect us, because we are neither a vote bank nor part of any vested interests.

Our specific objectives are:

- To create interest in financial markets and enhance financial literacy

- Protect investors and consumers of insurance, banking and other financial services through information, counselling and grievance redressal.

- To provide free access to the books to anyone who wants to learn more about finance and investment.

- To hold regular workshops and expert talks on financial issues.

- To provide a forum of networking among organizations involved in similar work and also support voluntary organizations working in this area. To collaborate with /assist/support organizations/ NGOs/ civil society groups that engage in public intervention to create a just, fair and a corruption free society.

- To educate the public of their legal rights in areas of investor protection through literacy programmes.

- To help prevent corruption and malpractices at all levels at the financial markets.

- To undertake qualitative and quantitative research and analysis in the areas of finance, economics, politics, public policies, environmental, business and all other allied fields.

- To provide a forum for committed volunteers and experts to involve themselves in a meaningful way for improvement in financial literacy and consumer protection.

- To create and promote enlightened public opinion on various issues affecting citizens, investors and consumers.

- To encourage, support and assist research and studies in financial, economic, social and related areas that affect individuals.

- To litigate and take any other lawful measures to safeguard the rights and interests of the investors and consumers.

- To create awareness and a sense of vigilance and responsibility among investors.

Founders & Trustees

-

Sucheta Dalal

Among the best known financial journalists in India, in 2006, Ms Dalal was awarded the Padma Shri, India government s third highest civilian award, based on her outstanding investigative journalism since the early 1990s. Her 35 years of investigative reporting spans the Harshad Mehta scam, CR Bhansali scam, and expose of Enron among others. She was the Financial Editor at The Times of India and has also written for Business Standard, The Economic Times, Indian Express and Financial Express among others. She served as a member of SEBI s primary market advisory committee, the Narayana Murty Corporate Governance Committee and as a member of Investor Education and the Protection Fund of the Ministry of Corporate Affairs. She has co-authored the best-selling book The Scam: From Harshad Mehta to Ketan Parekh and a biography of A D Shroff, a Titan of Finance.

-

Debashis Basu

A Chartered Accountant with 35 years of experience as a journalist and columnist and the author of several business books, Mr Basu has worked with The Times of India, Business World, Business India, Business Today, Financial Express and has written columns for Business Standard and The Economic Times. He has co-authored the best-selling The Scam: From Harshad Mehta to Ketan Parekh with Sucheta Dalal. He has served as the member of the mutual fund advisory committee of SEBI. He now writes a column for Business Standard every alternate Monday.

-

Walter Vieira

Mr Vieira is the former Chairman of the International Council of Management Consulting Institutes (ICMCI - World Apex Body) and a Certified Management Consultant (CMC). He has been a management consultant since 1975 and among the first to be elected a Fellow of the Institute of Management Consultants of India, FIMQ, in 1995. After working in for 14 years with Glaxo, Warner and Boots, he founded the first marketing consultancy firm in India in 1975, Marketing Advisory Services, which worked in the areas of strategic marketing, industrial market research, customer satisfaction measurement, and in-company training. He is the author of 14 books and visiting Professor at US Business schools, columnist and international circuit speaker.

Impact

Here are some of our biggest success stories. Please do share.

- Model Guidelines for Retirement Homes Announced >>

- RBI Asks Banks to Use External Benchmark for Floating Rates from Next Year >>

- RBI Asks Banks to Exchange Soiled Notes across Branches >>

- RBI Limits Customer Liability in Digital Transaction >>

- NRIs Eligible To File RTI Shows Corrected Reply from Lok Sabha >>

- Ministry asks SFIO to look into Helios & Matheson; ROC in 3 other Cases >>

- Pune RPO to soon become a model Passport Office >>

Our Work

Our work encompasses the following areas:

1. Awareness Sessions: We spread financial literacy and awareness about the rights of consumers and citizens through workshops, lectures, articles and awareness campaigns. We have conducted sessions on banking, aadhaar, real estate, consumer awareness, right to information, food & health, senior citizens issues, taxation and documentation, and many others.

2. Daily Counselling Sessions: As direct solutions to the problems that savers, consumers and citizens face, we guide them through one-on-one counselling.

3. Helplines: We run two free helplines with the help of our voluntary advisors and experts. The Legal Helpline offers guidance on vast variety of legal issues and real estate matters especially those pertaining to cooperative housing societies; the Credit Helpline guides people in financial distress on dealing with loan defaults, credit scores and so on

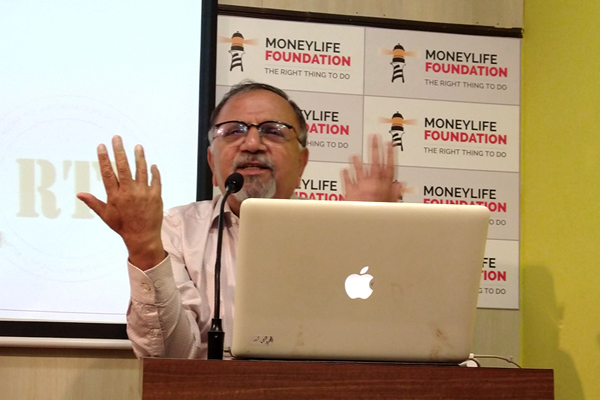

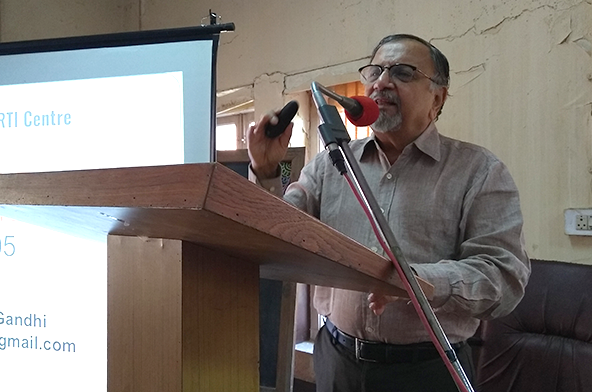

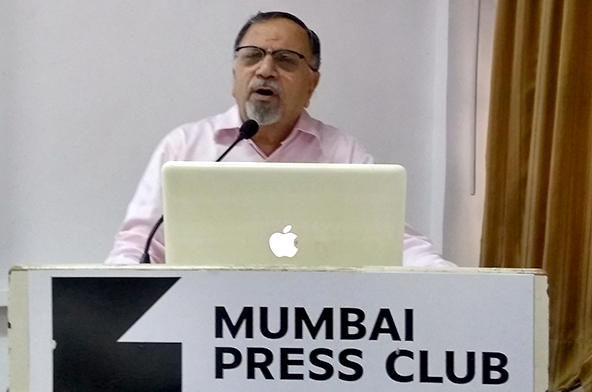

4. RTI Centre: We run a Right to Information Centre that was launched in September 2017 to create awareness on the Right to Information Act. More about it, below.

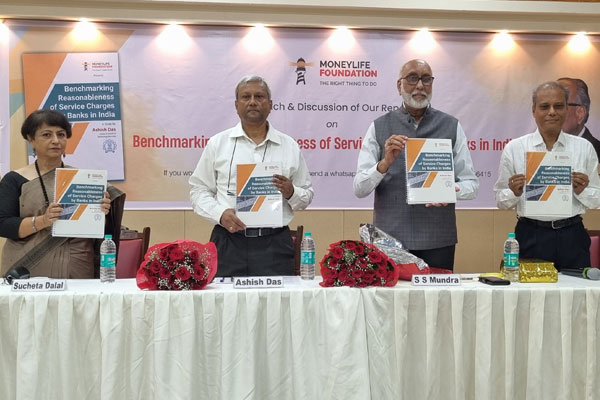

5. Research Projects: We take up specific issues that affect a large number of people look influence policy changes through in-depth research and recommendations that can benefit a large section of the population whose voice today does not reach the policymakers. We published research reports on Retirement Homes in India and on Reverse Mortgage Loans in India.

6. Representations: We advocate for safe and fair market practices through workshops, round table meetings, research and memorandums. Here are some of our important representations:

- Letter of Suggestions on improving BEST

- Memorandum to RBI on Bank ATM Charges

- Senior Citizens Issues

- Memorandum on Improving Mumbai Suburban Rail Network

- Memorandum on excess interest charged by banks under base rate and MCLR regime

- Letter to IRDA on fraud selling of Life Insurance products by Reliance Life and Bharti Axa Life

7. Legal Action: At times, we have also filed public interest litigations (PILs) on matters that have affected our members and have taken it up with the Supreme Court. Our recent PILs have been on LIC s Jeevan Saral and egregious bank charges that consumers are paying.

The foundation has set up Moneylife Knowledge Centre, a lecture hall and reading room with more than a thousand books on business, economics and finance. Although among the smallest, Moneylife is the only media company to have taken this kind of non-profit initiative.

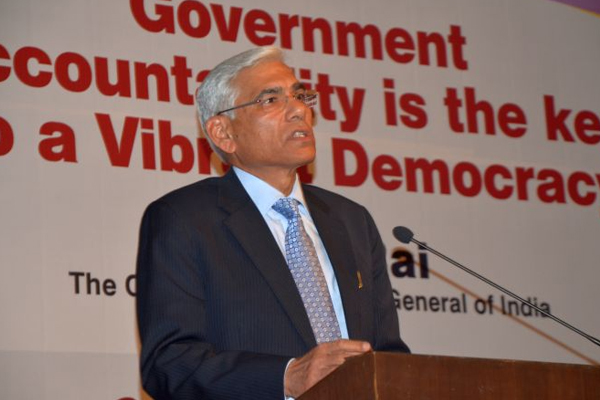

RTI Centre

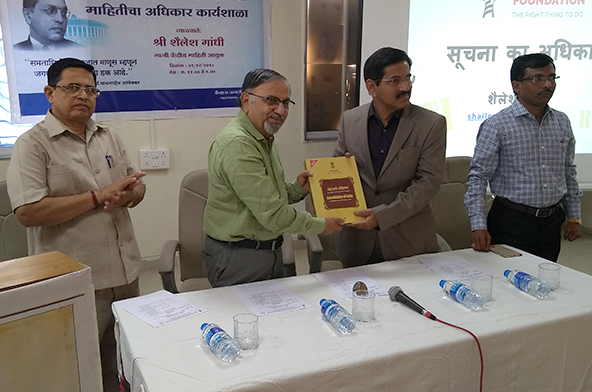

The Right to Information (RTI) Centre was launched in September 2017 with generous support from Mr Dinesh Thakur (Whistleblower of Ranbaxy s practices). The Centre s aim is to spread the awareness on Right to Information (RTI) Act and to bring about more transparency and accountability in governance. The RTI Centre conducts seminars, workshops, events and programmes in colleges, institutes in and around Mumbai and Pune for spreading awareness about the Act. Besides this, it also conducts special workshops for the Public Information Officers (PIOs) on RTI. The programmes are conducted by eminent RTI experts such as Central Information Commissioner (CIC) Mr Shailesh Gandhi, Mr Vijay Kumbhar, Mr Anil Galgali, Ms Vinita Deshmukh and others. The centre also runs a guidance clinic every Wednesday to help in resolving queries of people and on-spot filing of RTI applications.

MoreEvents

-

15 Nov 2025

15 Nov 2025Masterclass on Cyber Safety for Elders

-

28 Aug 2024

28 Aug 2024Challenges in Transmission of Assets Report

-

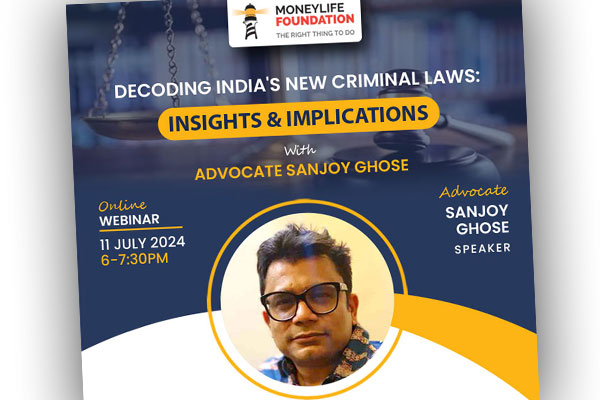

11 Jul 2024

11 Jul 2024Decoding India's New Criminal Laws

-

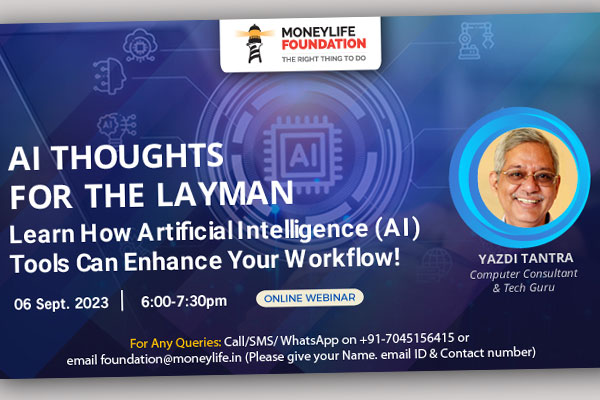

06 Sep 2023

06 Sep 2023AI Thoughts for the Layman

-

05 Apr 2023

05 Apr 2023What Can Go Wrong With Your Credit Score

-

15 Mar 2023

15 Mar 2023How Not to Become A Victim of Online Frauds

-

22 Feb 2023

22 Feb 2023Challenges in Redevelopment of CHS

-

14 Dec 2022

14 Dec 2022Learn About Provisions of RTI Act

-

21 Sep 2022

21 Sep 2022Learn How to Counter Illegal Refusals to RTI

-

20 Sep 2022

20 Sep 2022Track Your Municipal Corporator's Performance

-

07 Sep 2022

07 Sep 2022Empower Yourself: Learn About The RTI Act

-

11 May 2022

11 May 2022Misuse of RTI by Citizens & PIOs

-

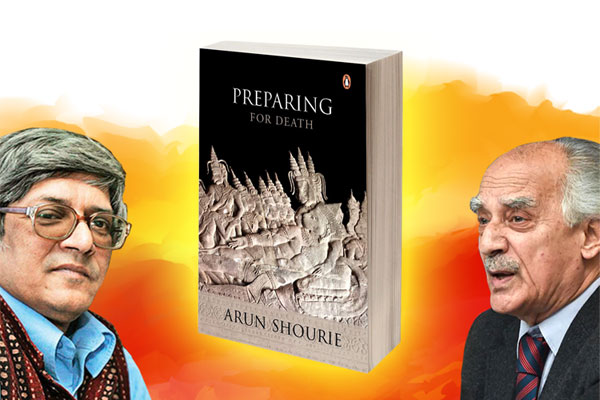

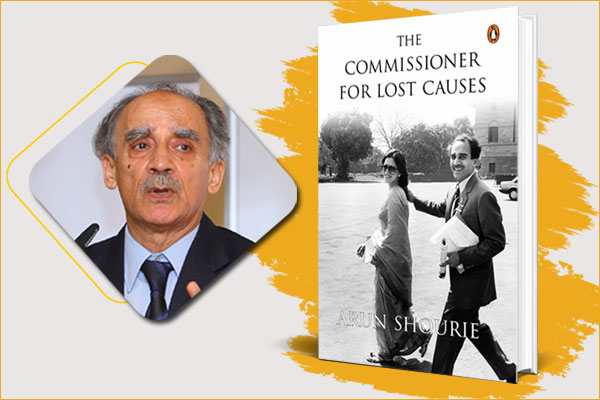

06 May 2022

06 May 2022A Conversation with Arun Shourie

-

27 Apr 2022

27 Apr 2022Saluting Our Covid Warriors

-

06 Jan 2022

06 Jan 2022Inaugural Corporate Governance Awards Programme

-

04 Dec 2021

04 Dec 2021Fourth Annual RTI Lecture

-

25 Nov 2021

25 Nov 2021Conversations on RTI with Shailesh Gandhi

-

27 Oct 2021

27 Oct 2021Conversations on RTI with Shailesh Gandhi

-

12 Oct 2021

12 Oct 2021Conversations on RTI with Shailesh Gandhi

-

29 Sep 2021

29 Sep 2021Conversations on RTI with Shailesh Gandhi

-

14 Sep 2021

14 Sep 2021Conversations on RTI with Shailesh Gandhi

-

01 Sep 2021

01 Sep 2021Conversations on RTI with Shailesh Gandhi

-

20 Aug 2021

20 Aug 2021Conversations on RTI with Shailesh Gandhi

-

14 May 2021

14 May 2021Join Us To Honour and Felicitate Mayur Shelke

-

11 Mar 2021

11 Mar 2021Disaster Recovery and Crisis Management

-

13 Feb 2021

13 Feb 2021How to Stay Safe from Online Phishing

-

19 Dec 2020

19 Dec 2020Third Annual RTI Lecture

-

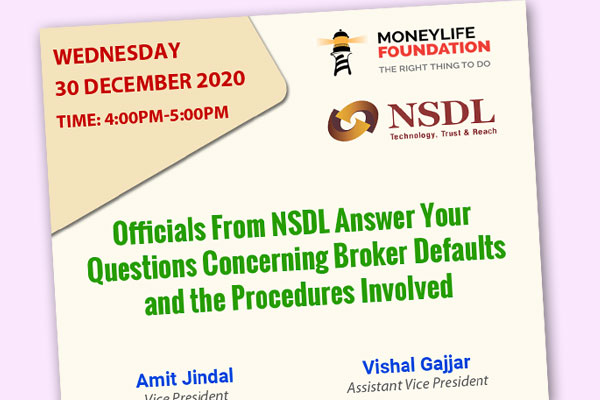

12 Oct 2020

12 Oct 202015 Years After The RTI Act's Implementation

-

22 Sep 2020

22 Sep 2020Why Are Wills Imperative? & Impact of SC Ruling

-

14 Sep 2020

14 Sep 2020Understanding NSE's Grievance Redress Process

-

03 Sep 2020

03 Sep 2020What was Wrong with Anugrah's Promise?

-

26 Aug 2020

26 Aug 2020How Not to Become a Victim of Online Frauds

-

19 Aug 2020

19 Aug 2020Learn from Advocate Manoj Harit

-

29 Feb 2020

29 Feb 2020Moneylife Foundation 10th Anniversary

-

24 Jan 2020

24 Jan 2020RTI Session For Students Of SIES, Nerul

-

18 Jan 2020

18 Jan 2020Maintaining Brain Health

-

17 Jan 2020

17 Jan 2020Money Traps That Decimate Savings

-

08 Jan 2020

08 Jan 2020RTI Bachao aur RTI users ko bhi bachao

-

23 Nov 2019

23 Nov 2019Maintaining Brain Health

-

21 Nov 2019

21 Nov 2019Reclaiming Mumbai's Open Spaces

-

20 Nov 2019

20 Nov 2019RTI Workshop For Students of Maharashtra College

-

23 Oct 2019

23 Oct 2019RTI Workshop for Students of New Law College

-

12 Oct 2019

12 Oct 2019PMC Bank Fraud: Who Pays? Who's Accountable?

-

30 Sep 2019

30 Sep 2019Launch of Dr. Subramanian Swamy's new book

-

27 Sep 2019

27 Sep 2019How Can I Use RTI? Experts Guide You

-

23 Sep 2019

23 Sep 2019How Pharma Companies Fudge Data

-

22 Aug 2019

22 Aug 2019How to Decongest Mumbai City

-

08 Aug 2019

08 Aug 2019Mumbaikars vs Potholes: How to Win This Battle

-

07 Aug 2019

07 Aug 2019Social Audits and How RTI Act Empowers Them

-

06 Aug 2019

06 Aug 2019RTI Workshop for Students of St Xavier's College

-

02 Aug 2019

02 Aug 2019RTI Session for Students of Wilson College

-

31 Jul 2019

31 Jul 2019Join us for a #SaveRTI Signature Campaign

-

19 Jul 2019

19 Jul 2019Success story against Mandatory Aadhaar Linking

-

19 Jul 2019

19 Jul 2019RTI Workshop for Students of Jai Hind College

-

26 Jun 2019

26 Jun 2019Fighting Your Civic Battles Using RTI

-

14 Jun 2019

14 Jun 2019Fire Safety & Prevention

-

12 Jun 2019

12 Jun 2019Tips & Tricks for the Lazy RTI User

-

08 Jun 2019

08 Jun 2019How to File Banking Complaints?

-

07 Jun 2019

07 Jun 2019Urban Infrastructure Challenges in Mumbai

-

31 May 2019

31 May 2019Self-Redevelopment - Benefits & Challenges

-

22 Feb 2019

22 Feb 2019RTI Workshop for Balaji College of Law

-

02 Feb 2019

02 Feb 2019How to Optimise your Borrowing?

-

28 Jan 2019

28 Jan 2019RTI Workshop with Shailesh Gandhi

-

19 Jan 2019

19 Jan 2019How to Travel on Budget

-

28 Dec 2018

28 Dec 2018Basics of RTI and understanding RTI Act - Nasik

-

27 Dec 2018

27 Dec 2018Remembering Nagesh Kini

-

24 Dec 2018

24 Dec 2018RTI Session for Students of SNDT College

-

08 Dec 2018

08 Dec 2018RTI session for Students of Jai Hind College

-

14 Nov 2018

14 Nov 2018Effective Use of RTI for SRA Projects

-

05 Oct 2018

05 Oct 2018How to Use Social Media for Public Good

-

01 Sep 2018

01 Sep 2018RTI session at Adv Balasaheb Apte College of Law

-

31 Aug 2018

31 Aug 2018RTI Session at Pravin Gandhi College of Law

-

26 May 2018

26 May 2018Right To Information: A Constitutional Right

-

17 Mar 2018

17 Mar 2018Sensible use of RTI and Alternatives

-

10 Feb 2018

10 Feb 2018RTI, Privacy and Aadhaar

-

13 Jan 2018

13 Jan 2018Moneylife Foundation’s 8th Anniversary

-

06 Jan 2018

06 Jan 2018Tax Adda with CA Ameet Patel on Facebook LIVE

-

02 Sep 2017

02 Sep 2017HOW TO USE RTI FOR INCOME TAX REFUNDS

-

10 Feb 2017

10 Feb 2017Tax Provisions of Budget 2017

-

04 Feb 2017

04 Feb 2017Moneylife Foundation’s 7th Anniversary

-

04 Feb 2017

04 Feb 2017MBA Students Get To See the Historic BSE

-

30 Dec 2016

30 Dec 2016“YOGA ON A CHAIR” Baba Ramdev’s Health Package

-

12 Dec 2016

12 Dec 2016Theft, Chain snatching and house break-in

-

24 Nov 2016

24 Nov 2016Demonetisation to usher in tax terrorism?

-

10 Aug 2016

10 Aug 2016Life How to file FIR and what are your rights

-

03 Aug 2016

03 Aug 2016CDO needs more volunteers to empower citizens

-

10 May 2016

10 May 2016Transforming governance with app-based platforms

-

05 Apr 2016

05 Apr 2016BMC Budget: Only outlays and not outcomes

-

01 Apr 2016

01 Apr 2016How to deal with Wills and intestate succession

-

10 Mar 2016

10 Mar 2016Protect your Family from Mobile Tower Radiation

-

05 Mar 2016

05 Mar 2016International Women's Day - 2016

-

06 Feb 2016

06 Feb 2016Moneylife Foundation 6th Anniversary

-

23 Dec 2015

23 Dec 2015Money Life of management students

-

29 Oct 2015

29 Oct 2015Safe and smart financial advice for students

-

19 Oct 2015

19 Oct 2015How not to become a victim of cyberfraud

-

14 Sep 2015

14 Sep 2015“So far, it is a normal market correction”

-

23 Jul 2015

23 Jul 2015Safe and smart money advice for college students

-

04 Jul 2015

04 Jul 2015Moneylife Seminar: 10 ways to save on mediclaim

-

08 Mar 2015

08 Mar 2015International Women's Day - 2015

-

07 Feb 2015

07 Feb 2015Moneylife Foundation 5th Anniversary

-

23 Jan 2015

23 Jan 2015Can opinion polls predict election outcomes?

-

31 Oct 2014

31 Oct 2014Be Safe & Smart with your Investments

-

19 Aug 2014

19 Aug 2014What they don't teach you at Business School

-

06 Aug 2014

06 Aug 2014What all women need to know about money

-

21 Jun 2014

21 Jun 2014How to win your case in Consumer Court

-

27 May 2014

27 May 2014The Flaws in our Laws

-

23 May 2014

23 May 2014Make the Government Work For You!

-

18 Apr 2014

18 Apr 2014How to use the RTI Act to Empower Yourself

-

11 Apr 2014

11 Apr 2014The Essentials of a Good Will

-

28 Mar 2014

28 Mar 2014The Whistleblowers Act: Will it work?

-

21 Mar 2014

21 Mar 2014Choosing the Correct Forum and the Right Lawyer

-

08 Mar 2014

08 Mar 2014International Women's Day - 2014

-

08 Mar 2014

08 Mar 2014SAVVY SAVING FOR SMART WOMEN

-

01 Mar 2014

01 Mar 2014Back to Basics: Be Safe & Smart with Your Money

-

28 Feb 2014

28 Feb 2014Documentary screening of "A Thin Dividing Line"

-

21 Feb 2014

21 Feb 2014Legal Resource Centre launch

-

01 Feb 2014

01 Feb 2014Moneylife Foundation's 4th Anniversary

-

18 Dec 2013

18 Dec 2013Sexual Harassment at the Workplace?

-

08 Nov 2013

08 Nov 2013Mumbai launch of book ‘The Descent of Air India’

-

04 Oct 2013

04 Oct 2013Fixed-Income: High Returns, Safe Capital

-

20 Sep 2013

20 Sep 2013Keep your money safe: Avoid MLM schemes

-

14 Sep 2013

14 Sep 2013What the B-schools do not teach you

-

05 Sep 2013

05 Sep 2013Learn to Invest Safely in Stocks

-

31 Aug 2013

31 Aug 2013How To Write Your Own Will

-

09 Aug 2013

09 Aug 2013Buying Stocks Safely!

-

06 Jul 2013

06 Jul 2013How To Write Your Own Will

-

28 May 2013

28 May 2013Insurance at 50+ Make Sure You Get it Right!

-

15 May 2013

15 May 2013Invest Smartly!

-

04 May 2013

04 May 2013GOLD TURNS COLD

-

27 Apr 2013

27 Apr 2013Keep your money safe: Avoid Chain-money schemes

-

23 Mar 2013

23 Mar 2013Retirement Savings-I: How Much is Enough?

-

08 Mar 2013

08 Mar 2013International Women’s Day 2013

-

15 Feb 2013

15 Feb 2013Moneylife Foundation's 3rd Anniversary

-

10 Mar 2012

10 Mar 2012Moneylife Foundation honours Goa women activists

-

10 Mar 2012

10 Mar 2012A non-partisan Financial Literacy workshop

-

05 Feb 2012

05 Feb 2012MONEYLIFE FOUNDATION'S 2ND ANNIVERSARY

-

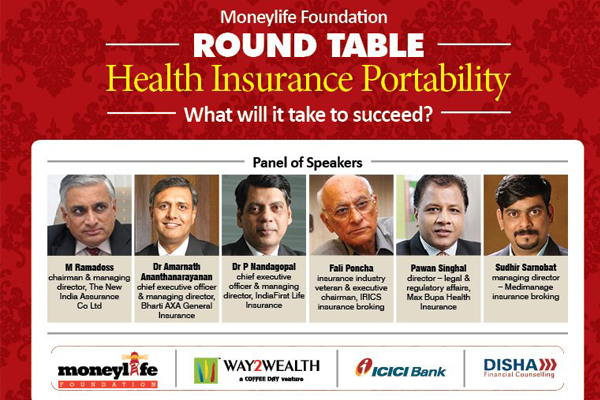

05 Apr 2011

05 Apr 2011Round Table: Health Insurance Portability

-

22 Mar 2011

22 Mar 2011Portfolio Management Services

-

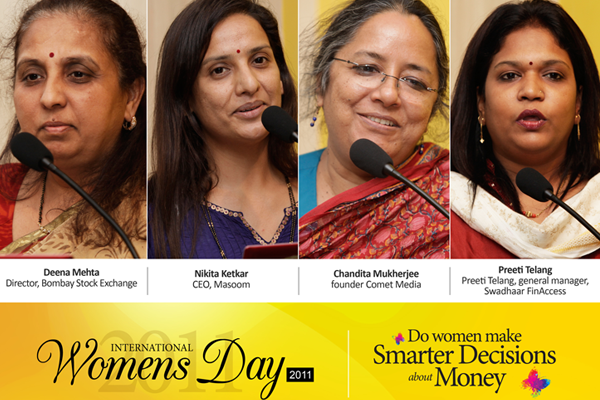

08 Mar 2011

08 Mar 2011International Women’s Day - 2011

-

05 Feb 2011

05 Feb 2011Moneylife Foundation’s 1st Anniversary

-

15 May 2010

15 May 2010A Workshop on Banking Services

-

05 May 2010

05 May 2010Real Estate: Trends, Issues & Consequences

-

04 May 2010

04 May 2010Be Safe & Smart with your Money

-

09 Apr 2010

09 Apr 2010Brainstorming Session for Senior Citizens

-

26 Mar 2010

26 Mar 2010Women & Finance

-

08 Mar 2010

08 Mar 2010International Women’s Day - 2010

-

27 Feb 2010

27 Feb 2010Union Budget 2010

-

06 Feb 2010

06 Feb 2010Inauguration of Moneylife Foundation

Representations

Moneylife Foundation was set up in 2010 with the realisation that consumers, savers, investors or essentially tax-paying middle class Indians, need advocacy, counselling, and sometimes litigation to make their voices heard.

As part of this effort, over the years Moneylife Foundation has submitted over 50 Memorandums & Representations.

Such representations on behalf of concerned citizens and consumers have been covered topics such as financial concerns of senior citizens, nefarious MLM schemes, Life & Health insurance, mis-selling by banks, ATM charges, LIC Jeevan Saral, reckless lending by mutual funds and more.

- Model Guidelines for Retirement Homes Announced >>

- RBI Asks Banks to Use External Benchmark for Floating Rates from Next Year >>

- RBI Asks Banks to Exchange Soiled Notes across Branches >>

- RBI Limits Customer Liability in Digital Transaction >>

- NRIs Eligible To File RTI Shows Corrected Reply from Lok Sabha >>

- Ministry asks SFIO to look into Helios & Matheson; ROC in 3 other Cases >>

- Pune RPO to soon become a model Passport Office >>