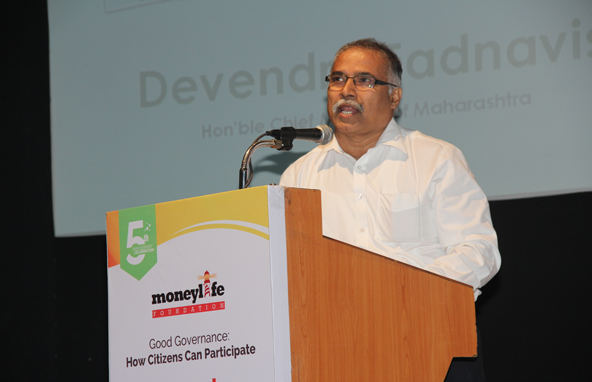

Devendra Fadnavis, Chief Minister of Maharashtra said, financial literacy and financial knowledge gives more power to citizens and help them understand investment risk and returns better. “Our government would like to work with institutions like Moneylife Foundation to make people financially literate. In addition, based on the ground level inputs from such institutions, we would also like make policies for investors. This will make people understand the difference between gain and loss on their investment,” he said while speaking to a packed audience at Moneylife Foundation’s 5th Anniversary in Mumbai.

Addressing a crowd of over 700 prominent citizens, businessmen, activists and whistle-blowers, the Chief Minister said, “Financial inclusiveness requires financial literacy. People are always in need of an instrument for saving. However, most of the time, they do not look at the ‘scheme’ or who and why is he offering such a higher returns. People do not even look at similar instruments in the market. We simply get attracted at higher interest rates without checking credentials of the offering party, and several times this ends it severe losses for investors.”

“एक आदमी था वह सौ रुपये का माल पचास में बेचकर लखपती बन गया. किसीने पूछा ये कैसे हुआ? तो बोले, पहले वह करोड़पती था! (There was a man who became millionaire by selling an item worth Rs100 at Rs50. Someone asked, how is this possible? He was billionaire before!!),” the CM said in a lighter vein, warning investors to be aware about the fact that nobody is in the market to give ‘fancy or sky high returns’.

Talking about Ponzi and money circulation schemes, Mr Fadnavis said, “Maharashtra is among the earliest states to put in place an act to save depositors. The Maharashtra Protection of Interests of Depositors Act provides for a competent authority, a special court in each district, attachment of properties, a wider definition of the term “deposit” and imprisonment of up to six years.”

“Soon, the state government is appointing a deputy collector to sell assets worth Rs5,000 crore seized from one of the biggest Ponzi operators in Maharashtra,” the CM announced.

Calling economic offences, especially using online media as biggest challenge emerging, Fadnavis explained how existing provisions in the Information Technology (IT) Act are making fast probe difficult in such cases. He said, “The IT Act mandates to register and probe any complaint by an officer not less than a police inspector (PI) rank. However, most the PIs joined the force before the IT Act and may not be tech savvy. At the same time, we have several police sub-inspectors (PSIs), who have sound knowledge and know how to use technology for investigations. We have requested the Centre to make suitable amendments in the IT Act to allow officers of PSI rank to register and probe online frauds.”

“Maharashtra, in the meantime, has decided to strengthen IT wing of police force and is training around 1000 officers on how to deal with IT related offences. This additional force would help us to prevent and crack such offences,” Mr Fadnavis added.

CM Fadnavis, who hails from Vidarbha region, said basic reason for farmer suicides in that area is due to absence of institutional credit. “Farmer suicides are directly connected with the availability of institutional credit. About 90% of banking activity in Maharashtra takes place in Mumbai, Thane and Pune area. This means, just 10% banking takes places in rest of the Maharashtra. This explains the low credit-deposit ratios in areas, where number of farmer suicides are higher.”

“Due to the absence of banking activities or institutional finance, farmer in regions like Vidarbha and Marathwada have no option but to take loan from private moneylenders. And when there is a single failure in crop, the farmer found it very difficult to get another option to rearrange credit from these moneylenders. This results in farmer suicide. However, economic growth is the real casualty in such regions caused by lack of widespread banking network or institutional credit,” Mr Fadnavis said.

Maharashtra Government has put out the draft of Right to Service (RS) Act or Maharashtra Guarantee of Public Services Act. In 2011, Mr Fadnavis had proposed the original draft, which stated that an official would be termed as ‘habitual defaulter’ after failing to provide service more than 50 times in a year.

He said, “We are inviting comments, views from government employees and citizens and would take a call based on the response. The Draft bill of Right to Services has been made public for suggestions and views and would be tabled in the budget session of State Legislature in March.”