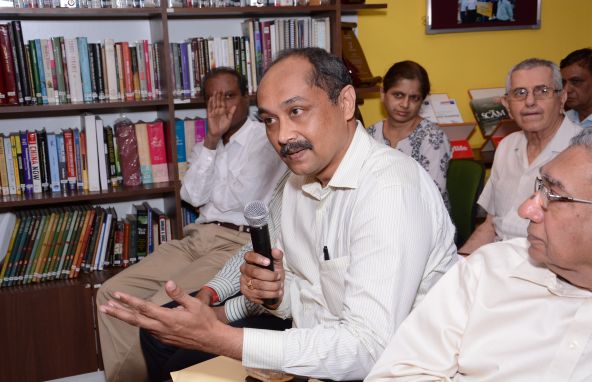

Moneylife Foundation was proud today, to hold an open house with its three newest trustees. Former Chief Election Commissioner, TS Krishnamurthy, Former Deputy Governor Dr KC Chakrabarty and COO at Flipkart Payment Gateway, Siddharth Das, graciously agreed to talk to Moneylifers and have an open discussion on a range of issues.

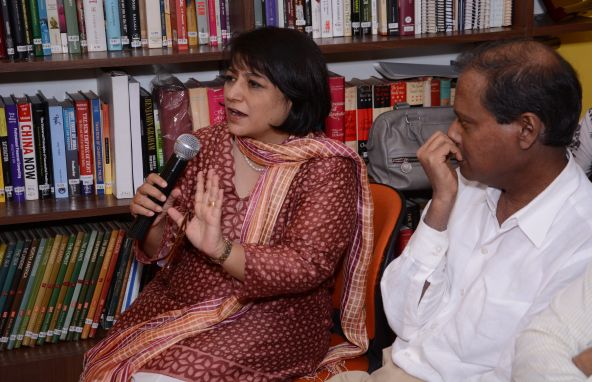

Three time Member of Parliament, and Congress Party leader Mr Sanjay Nirupam also graciously agreed to be a part of the event and be a part of the conversation. Ms Sucheta Dalal began by briefly introducing the four panellists and turning over the proceedings to the house immediately.

As was expected, the initial barrage was focussed around the most recent events, with the RBIs moves on ATM charges. Dr KC Chakrabarty, always frank and unencumbered by political correctness, took on the questions head on. He explained his personal position and the position of regulators around the world.

“First thing is that we must define deposit. Globally regulation is activity wise, in India it is institution-wise. We have neither a definition of deposits and neither is jurisdiction activity-wise. Globally, ‘deposit-taking’ is the regulated activity.” This is the root cause of the multiple regulators, and overlapping jurisdictions,” said KC Chakrabarty. “Charging somebody for withdrawing money is illegal and it does not happen anywhere,” He added.

Mr Sanjay Nirupam listened to both sides and as he had said at the outset, he had come to take back all the inputs he could, from both the regulator’s side and the consumers. An audience member asked, “shouldn’t there be a penalty if an ATM is not working?” Dr Chakrabarty’s reply was that “This has to be put in the contract between the bank and the customer, there is not other way to legally deal with this.”

Ms Dalal raised the issue of unregulated NBFCs and company deposits where even senior citizens lose huge sums of money. “I was party to a discussion in the Department of Company Affairs, where I said company deposits should be regulated only by RBIs, the DCA cannot regulate them because DCA does not perform audits,” he said.

Mr Krishnamurthy took on issues regarding taxation, laws in the Department of Company Affairs, where he was a senior bureaucrat, co-operative banks and NPAs. In the spirit of an open house, all questions were addressed by one or more panellists. On the wisespread issue with Cooperative Banks, Dr Chakrabarty said, “You will be shocked to know that majority of rural co-op banks are not even licensed. Co-ops are in a great mess for the past 100 years. My suggestion would be that for half percent or 1 percent interest more, don’t put money in these banks.”

Moving on to an issue of the future, Mr Yogesh Sapkale asked Siddharth Das what he felt about the payments systems in India, especially with regard to the IMPS and mobile money. Mr Das gave a detailed response on how the ecosystem works and the possible future routes to solving the problems faced today. “India has the best interbank payment system in the world, as with all fledgling systems there are teething problems, and with IMPS there are these problems because of the way the system is built, but these problems are improving,” he said, noting that there was good news too.

Following complaints by the audience that regulation was not keeping pace with the marketplace and the innovations all around the world, Dr Chakrabarty took the view that regulators are by nature the last to react. Taking the example of Bitcoin he explained that, “If we understand Bitcoin, we will allow it. Secondly, regulators are never smart, regulation is the next stage, if there is a demand, market will develop, and then the parliament will create a regulator. There is a thin line between innovation and violation, what the regulator calls violation, the market calls innovation.”

On the issue of valuations of online businesses, Siddharth Das explained that with huge capital inflows, the companies are able to offer discounts to customers, so that they increase the size of the market. Following which, Mr Nirupam asked on what the solution for taxing online sales could be, “Businesses will always go to places where taxes are lower. Unless and until taxes are imposed at source, this problem will always exist. With a federal set-up where each state has its own laws, this will happen,” Mr TS Krishnamurthy said.

On the emotive issue of black money, Mr Krishnamurthy explained that, “On the issue of black money, atleast 50% of black money is already converted into white. There is a misconception that black money is lying abroad in accounts. The fact is that black money tends to get converted to white quite fast.”

The subject of Non Performing Assets and Corporate Debt Restructuring came up during the discussion. Audience members raised the point that the big fish were getting away and Mr Nagesh Kini and Ms Dalal said that as in the case of Lanco Infrastructure, the RBI had even failed to provide information on the Rs9000 crore deal that the lenders cut with Lanco. Dr Chakrabarty said that, “CDR is an accepted tool, you are saying it is misused in India, industry is saying it is used very well.” Mr Krishnamurthy went on to explain that, “There are two types of restructuring, Corporate Debt Restructuring and Corporate Restructuring. CDR is a deal between the lender and the borrower. Dr Chakrabarty is right that you cannot force RBI to give you information about this private deal.

Government can give you this information but not RBI.”

In the course of the questions and answers, issues ranging from regulation, co-operative banks, defaults, NPAs, deposits, interest rates, lending practices, elections, election financing, black money, corruption, e-commerce, internet currencies, mobile payments and many other current issues were discussed. Mr Sanjay Nirupam ended the program with a suggestion that while it is true that Co-op banks are in a mess and they enjoy political patronage, there is no harm in the RBI making a little effort to connect wit the customers and be a little more customer friendly. Dr Chakrabarty answered that, he was in agreement with the suggestion but in practise this does not happen because the RBI’s mandate has been to make sure the banks survive.