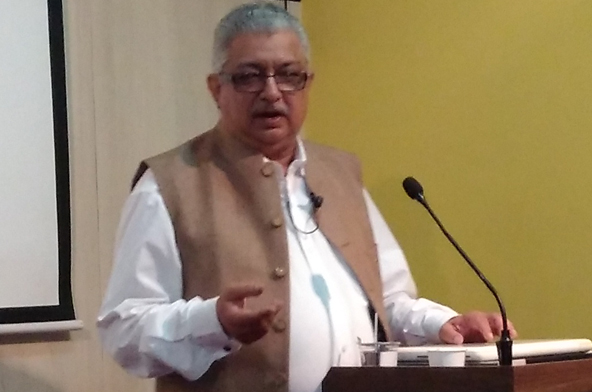

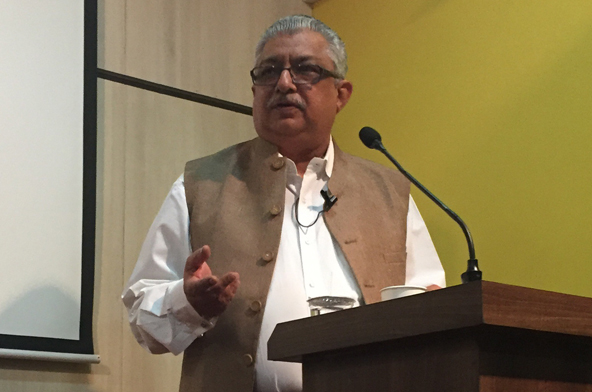

“Financial markets are game of speculation, where everyone wants to be ahead of others and control the situation. But it does not happen all the time. This is not the fault of the markets but operations that are manipulated and driven by speculations,” says Surin Usgaonkar, author of ‘Biography of an Indian Fund Manager’.

He was speaking at Moneylife Foundation during a discussion over his book. Quoting Jesse Livermore, known as the Boy Plunger and the Great Bear of Wall Street, the author said, “The game of speculation is uniformly and universally the most interesting games of all.” Time Magazine describes Jesse Livermore as the most fabulous stock trader from the US. He was famed for making and losing several multimillion-dollar fortunes and short selling during the stock market crashes in 1907 and 1929.

He said, “There is always a risk involved (in markets). The safety of your money cannot be guaranteed. Only god issues guarantees but unfortunately he is not in the habit of manifesting himself.”

“Whenever there is speculation, someone will play the role of Yudhisthir, Draupadi or somebody that of Shakunimama with his famous ‘pav baara’. Also stock market activities are game of passing the pillow, where as soon as the music stops, the one who holds the pillow is punished. But when the pillow is in the hands of common investors, every other player is safe and succeed. So you can say the common investor is the Draupadi in this market speculation Mahabharat,” Mr Usgaonkar added.

Mr Usgaonkar spoke about the book and what prompted him to write it. He said, “India is the only country across the world where economic offenses are perceived as manageable risks. That is why we have influx of all kind of funds, money from narcotics, blood money and even funds parked by those in power positions.

“The Biography of An Indian Fund Manager” is a fictionalised account of what happens in the Indian financial market from an insider who had a ringside view. The book is set in the post- economic liberalisation scenario and many of the events and characters will be familiar to people who followed the market then. The story in this book has a fascinating cast of characters – some downright dubious and corrupt, many, like the protagonist – who are reluctant participants in murky dealings – others like the brokers, bankers, police, underworld gangs, journalists, PR people, and many other players. The book also has one character of Mr Natrajan, a very middle class government official, who slowly gets sucked into speculating without knowing a thing about stock markets.

Mr Usgaonkar also spoke about the financial markets and how they have changed over time. He also describes some forms of manipulation in detail. ‘Operation Paplu’ that was the code name for manipulating the IPO subscriptions and listing is one such example. Things are different today, they are more automated, but that much of the manipulation exists, he added.

Mr Usgaonkar was General Manager of an asset management company (AMC) that was among the early ones who launched a private mutual fund and later chief executive of a large financial services company, gained an inside view of how deals are struck, bribes are paid, prices manipulated, subscriptions to an initial public offering (IPO) ‘managed’ and listing prices are fixed.

He says, “Speculators land in jail with empty pockets, and thieves with deep ones. Common investors should remember that the god lies in exits. So think about exit before entering the markets.”