“Investors have a right and a duty to go by the market risk. But this is beyond a market risk, this is actually a fraud,” said former SEBI GM Advocate PR Ramesh, while speaking at a webinar organised by Moneylife Foundation for aggrieved investors of Anugrah, who were trying to find a solution to recover their losses. Advocate Sumit Agrawal, former SEBI Legal Assistant, was also part of the webinar as Moneylife Foundation attempted to provide an open platform for investors to present their concerns and doubts.

As we have recently learned, Anugrah Stock and Broking is another firm in a series of such incidents, whose investors are facing losses totaling Rs1000 crores. Moneylife has been extensively covering this issue for the past couple of weeks and has also been writing about the serious gaps in investor protection laws.

The webinar began with the opening remarks from Adv Ramesh who explained how after years since the 1992 Harshad Mehta scam, investors have still “not been accustomed to handling of broking entities and entire systems and processes” and ended up getting caught in frauds such as Anugrah.

“Prior to Anugrah, we had Karvy, BMA, IndiaNivesh…we had a lot of issues. But still I think this algorithmic trading was sort of a tempter which actually made a lot of investors give money and maybe they were able to generate returns of 18-19% initially,” he explained.

According to him, frauds of this nature keep happening even after tight regulations partly because of naïve investors and also educated investors taking a market risk, but also because of lapses and failures on the regulatory side. He further stressed that such investors should not be forced to bear the brunt of the losses for an outright fraud. “We have to take them to task and shake up the system, so that such a fraud does not repeat again,” he added.

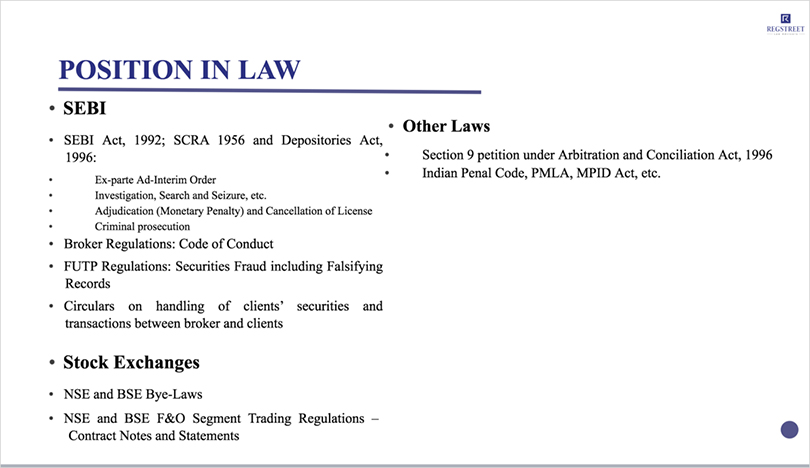

Adv Sumit gave a brief presentation covering the facts of the case that are available in the public domain, the actions that regulatory bodies have taken to date, the general position in law in such cases and also any possible steps that investors can take for recovery.

“In such cases, generally various laws kick in, either SEBI’s, BSE’s or NSE’s by-laws or Sec 9 of Arbitration and Conciliation Act, Indian Penal code, MPID Act etc. Legal advisors will have varying strategies depending on the client’s particular situation and their exposure to the broker or the associate of the broker,” explained Adv Sumit.

In his opinion, before connecting with any legal advisors, aggrieved investors should first collate information that is available and applicable to their particular case including, a demat holding statement, contract notes, margin statement, 3 years IT returns, profit statements provided by Teji Mandi and global profit statements and any correspondence with Anugrah or Teji Mandi.

“Having such documentation prepared in advance will not only give you a better picture of the position you are in, it will also provide a legal advisor better understanding of your particular case,” advised Adv Sumit.

During the course of the Q&A, many attendees present had some pressing questions on safe-guarding their savings from such frauds in the future and making prudent investments. Adv Ramesh in response to one such question, rightly observed that, “there is lot of material now available online, on what investors should do to protect their own investments…a lot of YouTube videos and educational materials. But the basic issue remains, that when you are dealing with your own money, please don’t be focused solely on the returns, but also on the safety part, which is the first and foremost thing. Documentation is also important, since many clients do not bother about documentation, so long as the cheques are coming to their bank accounts. This is where the fundamental problem begins.”

One of the attendees wanted to check if getting the company declared insolvent would help. In response to this, both Adv Ramesh and Adv Sumit unanimously replied that it would be a disastrous decision for the investors, since in cases of bankruptcy, and during distribution of assets, an equity holder or a futures and options holder are not a priority.

Throughout the webinar, both advocates vehemently agreed that the system was flawed, but to bring about change would be a monumental task that requires persistence and patience of aggrieved investors. Although there have been failures at each stage, from SEBI, the clearing corporation and the clearing brokers, investors will have to take swift action perhaps as a group to recover their losses.

Note: Moneylife Foundation has organised this webinar in the interest on educating investors and will not be directly filing a petition in the courts or representing any investors. This webinar has been part of our efforts to facilitate an action group where aggrieved investors can meet and discuss their way forward. In case you are an investor and are not part of our Anugrah-Teji Mandi-Action Group on Telegram, you can join using the below link: https://telegram.me/joinchat/OOrsZVXo_dP9ILG64VmtKw

Watch a video recording of the session: