It is ironic that there is little in management education that can prepare you for the intricacies and the realities of managing your money. Before students go out to join the corporate world, it is important for them to have a good understanding of what it takes to protect their money and invest smartly.

The first session was conducted by Sucheta Dalal, managing editor of Moneylife and founder trustee of Moneylife Foundation. She focussed on how students can avoid financial mistakes and falling prey to scammers. The second session was addressed by Debashis Basu, editor and founder trustee of Moneylife Foundation. Students do not only need to protect their money, they need to invest it wisely to beat inflation and fund their future goals. Mr Basu spoke on the pros and cons of different investment vehicles through which they create wealth.

The numbers of scams reported are infinite. In her session, Ms Dalal discussed that one should keep one’s financial life simple and one should invest in just a few products—products that are safe and well regulated. Ms Dalal spoke about the dubious schemes like QNET, Pearls, City Limouzine, Japan Life, which could be clubbed to category called Pyramid scheme or chain money schemes. These schemes claim to provide extremely high returns luring the unsuspecting savers and then vanish into thin air. Many have lost huge amounts of money in such schemes.

The six mantras, articulated by Ms Dalal, include – not to lose money, insure for securing future, avoid credit and investment traps, focus on few safe products, avoid emotional traps and maintain financial hygiene. Ms Dalal explained credit history, credit score and reports which are becoming increasingly important. She said, all your borrowings and repayments for credit card, student or education loan and other loans, are tracked by credit information companies, like CIBIL, Experian, CRIF Highmark and Equifax.

In the second session Mr Basu explained the importance of saving regularly to secure one’s future financially. He took the students through different life stages and the common financial goals at each stage in life. It is important to plan in advance for such goals. Everybody can make financial decisions, he said if they stick to some simple principles.

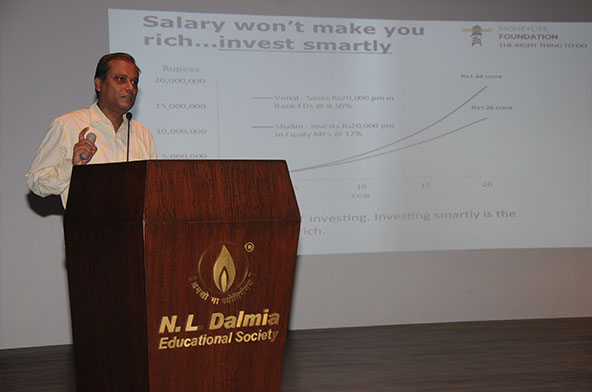

He explained the principles of compounding under different scenarios. The effect of compounding is slow in the initial periods, but as time passes on, the power of compounding takes over and the wealth created is huge. The key rule is to save as much as possible and as early as possible in good financial products. Many students look to earn a good income when they start work. Mr Basu highlighted that savings has little to do with income. It is more important to spend smartly.

Where does one invest? While not going in to detail on the various investment products available, Mr Basu gave the suggestion of just a few products that should do the job. As college students have time on their side, he advised them to invest in equity mutual funds and stocks with an investment horizon of 15 years or more.