“A plumber requires a license, and so does an electrician. But a builder only requires a sweet tongue and a smiling face. They do not require a license to operate. With MOFA (Maharashtra Ownership Flats Act) in place, education is there for estate agents, but I believe that more education is required for the builder community. They do so many wrong things just for profit,” says advocate Vinod Sampat. He was speaking at a recent webinar organised by Moneylife Foundation on issues related to the redevelopment of cooperative housing societies (CHS).

A renowned expert with decades of experience in housing society-related matters, Adv Sampat covered essential steps for a housing society to follow when opting for redevelopment and the challenges they must overcome during the process. He also candidly spoke on other important matters that directly affect consumers.

As per the stipulated rules and regulations, for a society to opt for redevelopment, its conveyance has to be completed first. As Adv Sampat explains, to complete conveyance, society needs to have the property card in the name of the rightful legal entity, and the property owner should join as a ‘confirming party’ as per the clauses in the model agreement.

However, builders have continued to exploit the ignorance of consumers blatantly. As he explains, “While the law stipulates that the property owner should be joined as a confirming party in an agreement, I have no hesitation in saying that despite this clause, the rules are being openly flouted by the builders. Banks are more than willing to give loans to the builder, even when they know it is a mistake being committed by them. It is, unfortunately, a very corrupt process.”

Over the years, he has observed many societies struggle to get conveyance or deemed conveyance done. For a speedy resolution, Advocate Sampat strongly recommends filing a consumer court case against the builder. “Simply file a consumer court case with a prayer for conveyance and the delay from the builder. Since conveyance requires property card to be in the legal entity’s name, your case will also look at such other formalities while the issue of conveyance is considered. In the end, when the matter is resolved other important formalities will also be completed prior to taking on redevelopment. ”

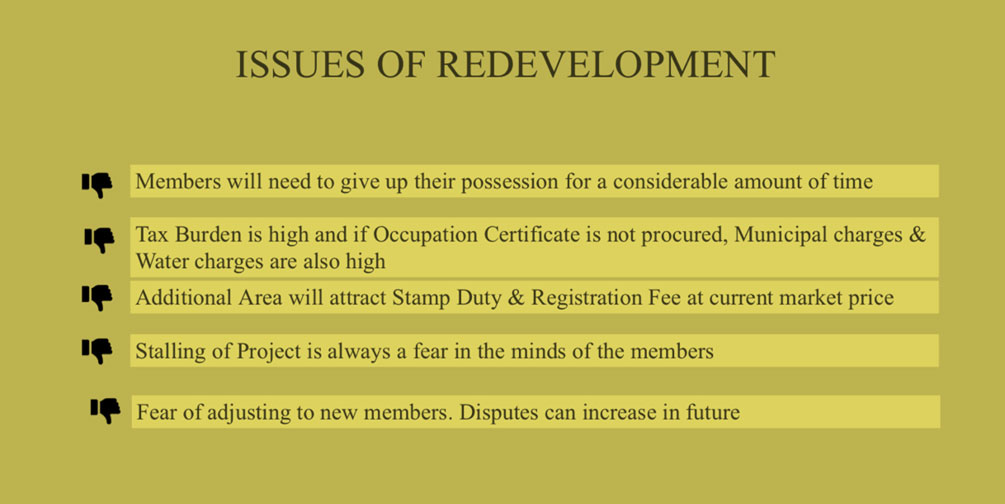

Tackling some issues when opting for redevelopment in a housing society can be challenging, especially with the number of stakeholders involved. But as Adv Sampat explains, overcoming these challenges can lead to a rewarding final outcome.

Problems such as “promise of unrealistic targets, insufficient funds, corruption, the difficulty of pleasing all stakeholders, tax burden and stamp duty implications, are unfortunately common when opting for redevelopment.” But each issue can be handled and addressed if planned for in advance.

While covering possible solutions to challenges during redevelopment, Adve Sampat recommended that consumers “always ensure their agreements are watertight. That specific clauses are included in the tripartite agreement, such as the option for arbitration in case of dispute, or a termination clause.”

Approaching the consumer court is always an option when the builder fails to adhere to the agreement and they can take the matter to the high court if the said agreement has to be terminated.

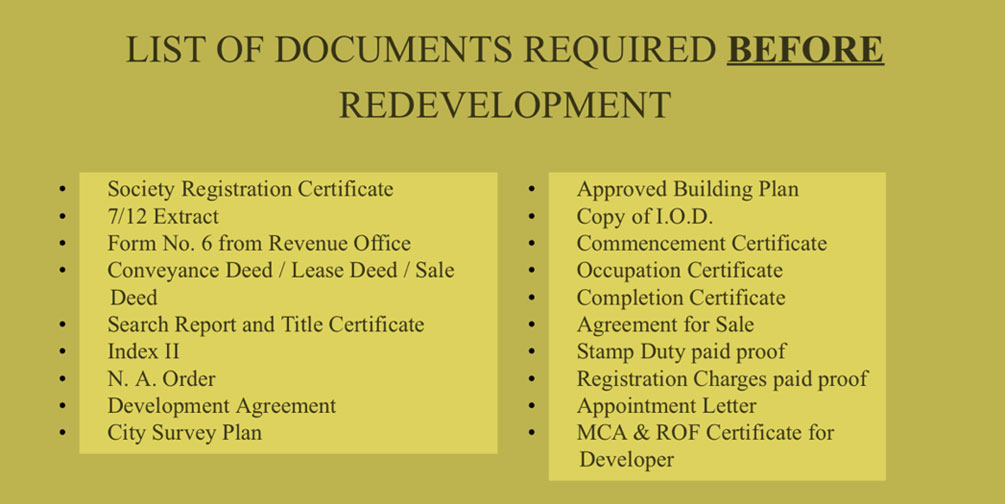

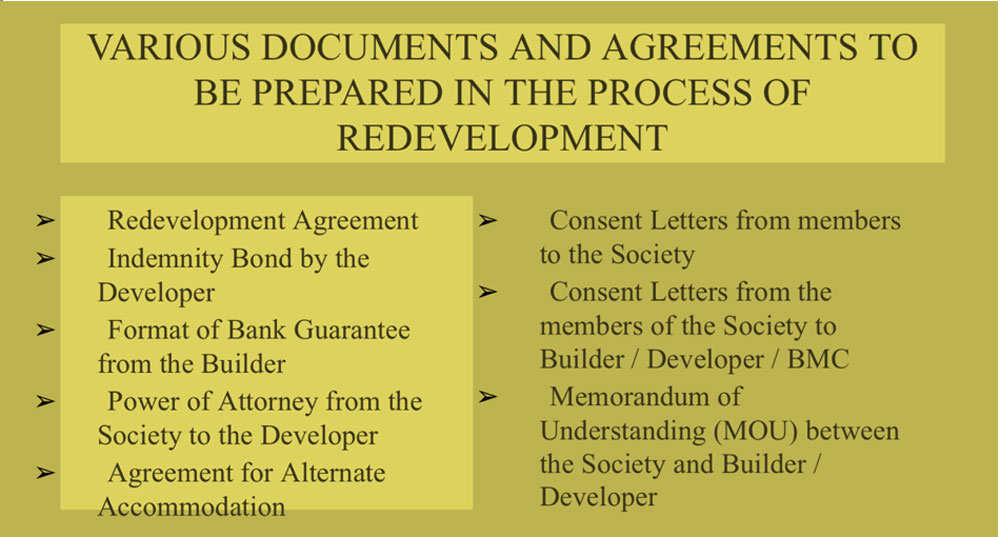

Other important recommendations were to ensure the project is RERA registered and that sufficient research is done about the builder to ensure they have a good track record. Advocate Sampat also briefly covered the list of documents required before opting for and during redevelopment, as well as the various agreements that are to be prepared during the process.

The session while hosted on Zoom, was also live streamed on Moneylife Foundation’s YouTube and Facebook channels.

Adv Sampat also took the time to answer specific queries raised at the end of his presentation. While some questions remained unanswered due to a shortage of time, readers are encouraged to make use of Moneylife Foundation’s Legal Helpline, where queries related to housing society matters are answered on a regular basis.

A video recording of the session can viewed below: