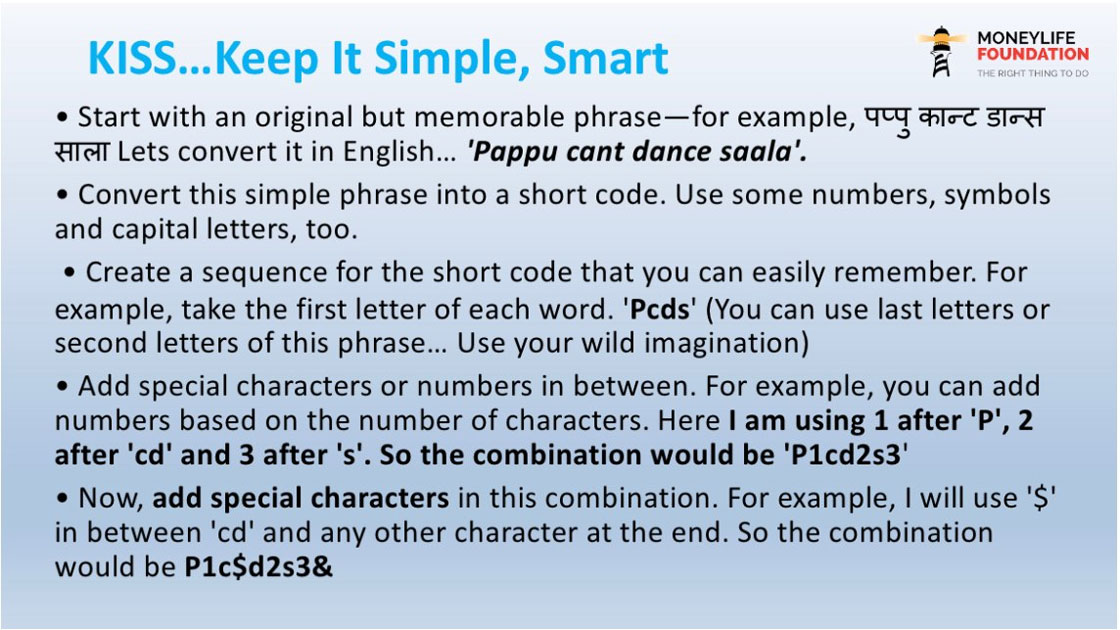

“Passwords are your first line of defence. You should never write them down nor save them in a password manager, as such managers can also be hacked, as we have seen recently. The most foolproof method of saving passwords is to have a mnemonic by which you can remember them. Even complex passwords can be simple to remember if you devise them from easy-to-remember phrases,” advised Yogesh Sapkale, deputy editor of Moneylife, while speaking at a webinar organised by Moneylife Foundation.

In an increasingly digital world, fraudsters have become smarter in using technology to their advantage and in devising new tricks to defraud unsuspecting users. Fraudsters look to exploit greed by luring users with lottery winnings, jobs or other lucrative offers. Some make use of the fear factor by posing as bank officers or service providers, scaring customers into sharing personal information like card details, OTP, UPI ID etc.

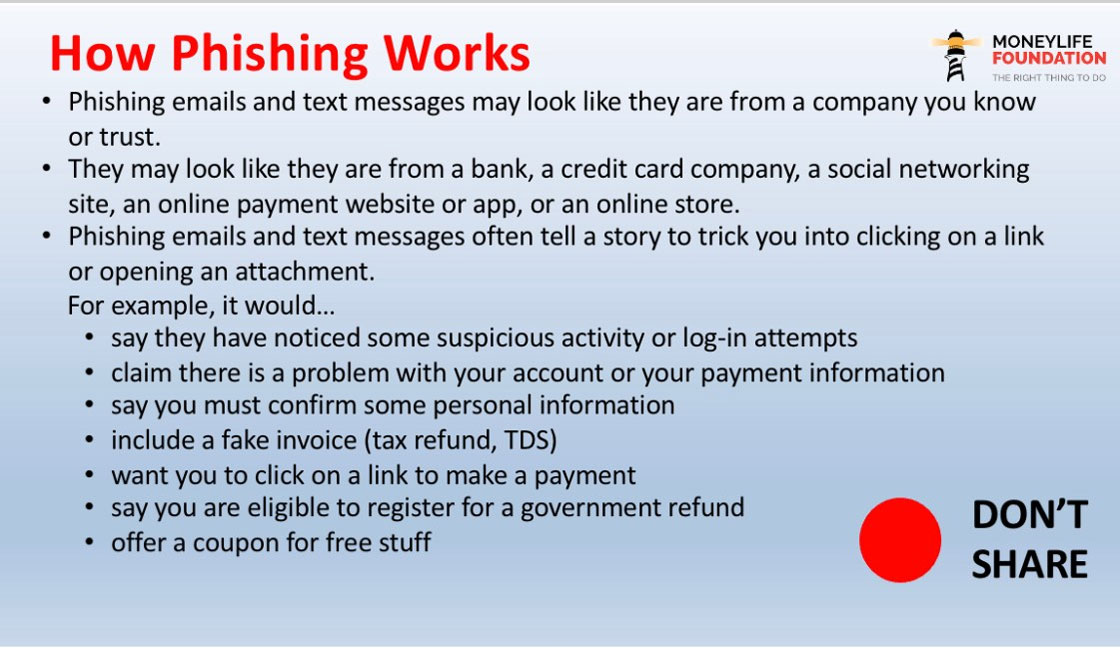

As Mr Sapkale explained in the webinar, one should never disclose personal details to anyone as that opens up the risk of losing one’s hard-earned savings through fraudsters. Phishing is a common way that fraudsters employ to gain a user's trust. In such techniques, emails or text messages appear as if they originate from genuine sources but in fact, contain masked links which are designed to steal sensitive personal information.

In the webinar, Mr Sapkale covered some of the most common scams, such as KYC frauds – where fraudsters steal personal information to access your bank accounts, electricity scams – where the scammer poses as an employee of the service provider and threatens to disconnect service if payment is not made, investment or crypto scams – where lucrative returns are promised to lure investors, online shopping frauds, sextortion, matrimony scams, fake crowdfunding and others.

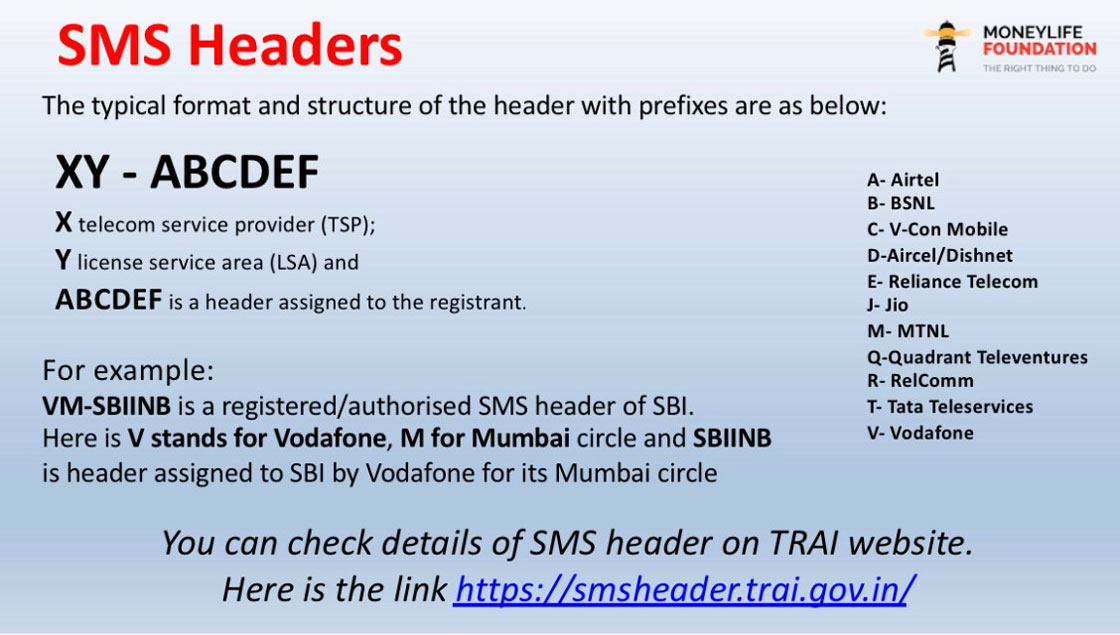

He also explained the basics of identifying fraudulent messages, emails, links, websites, apps and software. “All official messages or emails, links and even websites have identifiers like headers, and valid security certificates, which indicate the authenticity of the message or link. Users should always look out for such identifiers before blindly clicking on a link or even forwarding a message. Such masked links may install unwanted spyware or virus into your device, which may expose sensitive data to scammers.”

Most importantly, Mr Sapkale strongly advised users to “never respond to an unknown caller’s request to visit a portal or click a link; do not download any app just because an unknown person wants you to.”

Installing anti-virus software is a must for protection from viruses, malware, ransomware and remote access software, he says.

Mr Sapkale also discussed the steps one could take when scammed by fraudsters – lodging a complaint with the concerned entity and following it up with the higher authorities. The session ended with questions taken from the attendees who had joined on Zoom. It was also live-streamed on the Facebook and YouTube channels of Moneylife Foundation.

Interested readers can check the fraud alert columns written by Yogesh Sapkale on Moneylife.in.

A video recording of the session is available on our YouTube channel: