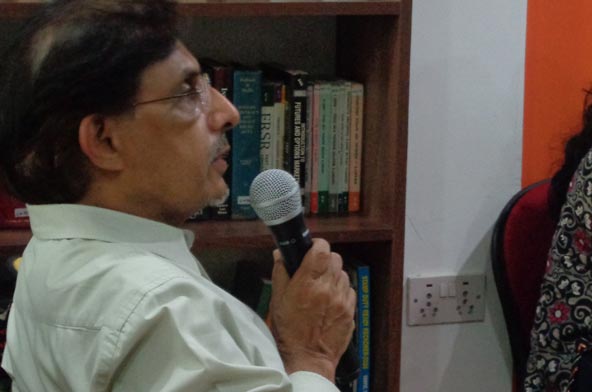

Although income tax refunds are now processed faster, there are still several taxpayers awaiting for refunds or other tax related issues including a mismatch in their filings and what is captured from other sources by the tax department. Although most people panic about anything to do with the tax department, there are simple and effective ways to resolve issues by following systematic process, making a cogent application and persistent follow up, explained Mr Rajesh Gada, Chartered Accountant (CA) and a Certified Financial Planner (CFP). He was speaking at a daily clinic organised by Moneylife Foundation to help people file RTI for tax refunds.

“After filing your grievance letter, follow it up with a reminder, which also states your intention to file an application under Right to Information (RTI) Act or to approach the tax ombudsman, in a polite way; if you still do not get the information you need or a refund, then file a formal application”, he said.

Mr Gada, who is also actively involved as a volunteer in spreading awareness and guiding people about RTI Act through Tarun Mitra Mandal pointed out that this process has a fairly high success rate and there is often no need to file an RTI. Moreover, the process of sending multiple reminders is also helpful when one approaches the tax ombudsman, since it is clear that one has made every effort to have the issue redressed.

While there are different mechanisms available to resolve grievances with the tax refunds, if one is careful while filing income tax returns, then the question of not receiving refund in time will not arise, Mr Gada said.

He said, “If necessary and applicable, the assessee should file Form 15 G (if her income is below threshold limit before deduction under chapter VIA) and Form 15 H (by senior citizen if tax payable is nil after availing deductions), try to pay exact or a little-bit lower tax, be careful while adding TAN and amount of the tax deductor (like an employer) and regular checking of form 26AS and taking necessary steps will help reduce the instances of refund.”

Many a times, assessee while paying the tax make mistake in the challan. In such matters, the mistake can be rectified by bank if the assess approaches within seven days and thereafter by the assessing officer, says Mr Gada, who is Director at Gada & Haria Financial Planners Pvt Ltd.

He informed about various grievance redressal mechanisms in income tax matters. Mr Gada says, “For online grievance redressal, the taxpayer can visit Incometaxindiaefiling.gov.in and use the e-nivaran facility. In addition, if the grievance remains unanswered, then the assessee can approach the Income Tax Ombudsman. The Centralized Public Grievance Redress and Monitoring Systems at PGPortal.gov.in can also be used by the taxpayer.”

While there is no fixed format for filing RTI with the Income Tax Department, Mr Gada shared a sample format used by him.