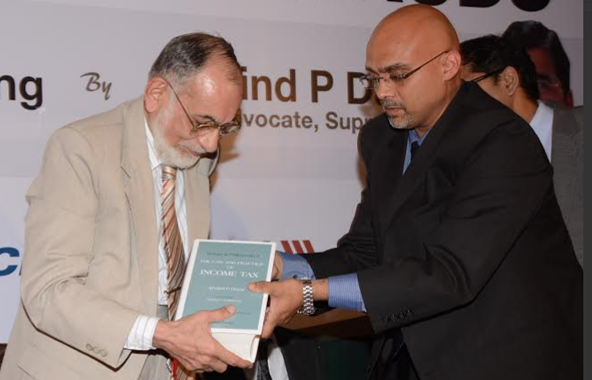

Renowned tax jurist Sohrab Erach Dastur, popularly known as Soli Dastur, said today that income tax (I-T) will be respectable if greater compliance is encouraged for all, especially those who administer it. He was speaking at a Moneylife Foundation event to launch 10th edition of Kanga & Palkhivala’s ‘The Law & Practice of income-tax’ updated by prolific writer and senior advocate Arvind Datar, in Mumbai. The packed audience of Moneylife Foundation was also addressed by the former Chief Justice of the Supreme Court, Justice Sam Bharucha. Also present in the dias was Behram A Palkhivala, the brother of Nani Palkhivala.

Lauding the efforts taken by Mr Datar in updating the book, Mr Dastur said, “This is not just a compendium of I-T related cases, but Mr Datar has not hesitated to comment on certain judgements and provisions of the I-T Act. Mr Datar even criticised a few decisions given by Courts like the reopening of assessment.”

Expressing unhappiness over courts deliberating over cases where some other court has already given judgements after word to word scrutiny of the I-T law, Mr Dastur said, “(The Courts) should not start fresh look again and again. Courts really need to be updated about such cases by advocates.”

Talking about modern tax laws, Mr Dastur said, “There is a need to improve tax administration. If you don’t give tax credit where it is due, then taxpayers would not respect you.”

Mr Dastur also expressed that Mr Datar should come out with updated edition of the book on 16 January 2020, the birth centenary of Nani Palkhivala. Replying to this, Mr Datar said he would try and bring not 11th but 12th edition of this classic book. He also informed the audience about the overwhelming response received for the 10th edition and how the publishers, LexisNexis are compelled to reprint the edition in such a short time due to huge demand.

The first edition of Kanga & Palkhivala’s ‘The Law & Practice of income-tax’ was released in 1950 when Palkhivala was just 30. The success of the book triggered off a copyright-infringement suit by Sampath Iyengar, the author of “Law of Income-tax” and an accomplished lawyer. Mr Iyengar argued that Palkhivala had copied from his book.

How Mr Iyengar built his case and how Mr Palkhivala defended himself successfully is a fascinating and compelling story in itself. Interestingly, the judgement of Madras High Court in this case has not been reported in most of the law journals even though it was the first in India on copyright violations related with a commentary on a statute. Legal luminaries Soli Sorabjee and Arvind Datar have put together the fascinating battle between Mr Iyengar and Mr Palkhivala, two of the finest legal minds, in a book called, “Nani Palkhivala: The Courtroom Genius”.

Coming back to the ‘The Law & Practice of income-tax’, after the demise of Palkhivala, the publisher brought in Supreme Court lawyer Dinesh Vyas to update the book. Mr Vyas ensured that the core of the book remains untouched and only necessary updates were added in the book.

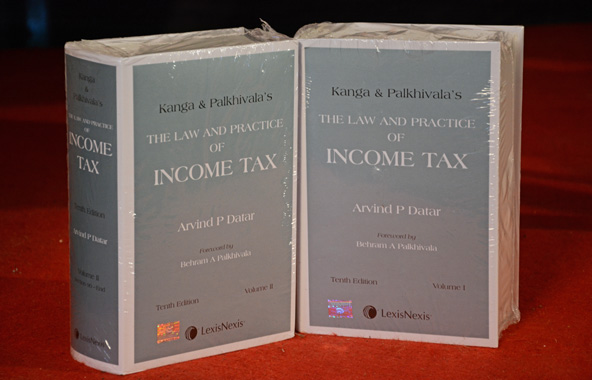

For the latest and 10th edition, the publishers handed over the baton to lawyer cum author Arvind Datar. The book contains a pure statement of the law, based on case law and the statute, as amended from time to time.

In contrast with other books, the focus is not on computations and administrative matters but an exposition of the principles governing income-tax law. The commentary by Mr Datar also takes into account all the amendments right up to the present date.

The two volume book also comes with a CD that contains entire text of Income Tax Act (1922 and 1961), the Income Tax Rules, the Double Taxation Avoidance Agreement as well as important circulars and all allied Acts and Rules.