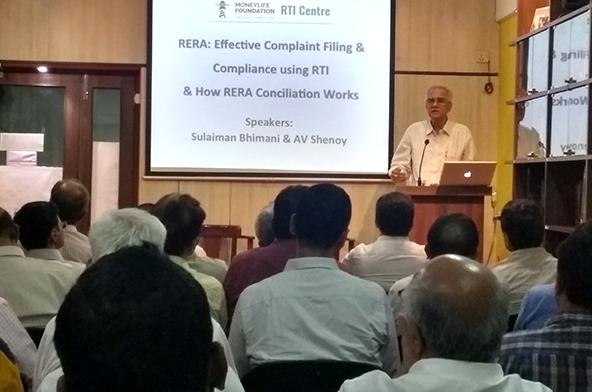

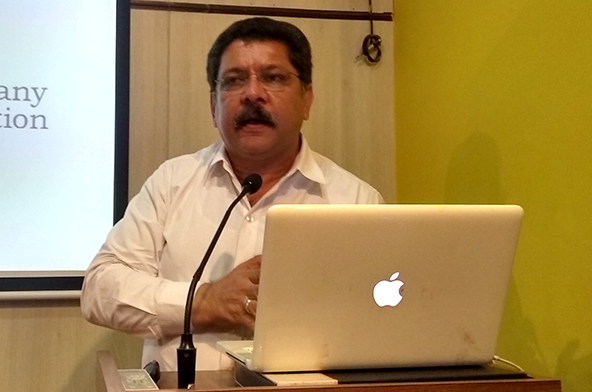

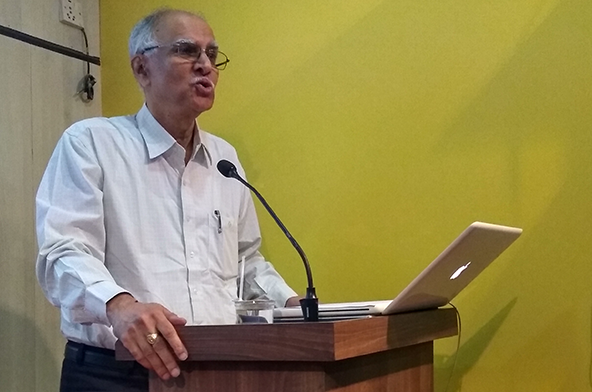

“The Real Estate (Regulation and Development) Act (RERA) has punitive provisions not just for builder or promoter and real estate agents, but also for allottees or buyers. However, RERA is quite strict on promoters and agents and had mandatory compliance provisions,” says Sulaiman Bhimani, an RTI activist and Founder-President of Citizens Justice Forum. Following advocacy from consumer organisation, the Central government provided an alternate dispute redress mechanism or conciliation process, which is turning out to be quite useful for buyers, added Ajit V (AV) Shenoy. Both Mr Bhimani and Mr Shenoy were speaking at an special workshop, “RERA: Effective Complaint Filing & Compliance using RTI & How RERA Conciliation Works”, organised by Moneylife Foundation’s RTI Centre in Mumbai.

According to Mr Bhimani, under the Law, the promoter or builder or developer cannot advertise, book or sell any plot or flat without registering the project with RERA. “Validity of registration remains till the date of completion as stated by the promoter. However, if the promoter tries to sell flats without registering the project with RERA, he is levied a penalty of more than 10% of the estimated cost of the project.”

There, however, are certain cases where the promoter is not required to register his project with RERA. “If area of the land to be developed is lower than 500 square meters, or number of apartments are less than eight, or where completion certificate is received prior to 1 May 2017, then he is not required to register the project with RERA,” Mr Bhimani, who had exposed several illegal constructions, corruption and land deals relating to SRA and MMRDA, added.

RERA provides a relief for buyers, as there are provision like Section 12 that deals with claiming loss sustained due to incorrect or false statement in advertisement or prospectus. He said, “Section 13 clearly says, if there is no agreement for sale then there is no question of paying any advance or deposit to the builder. Next, section 14, mandates the promoter to adhere to sanctioned plan and not make any changes without nod from the buyers.”

Real estate agents are also mandated to register with RERA. “Registration of agents is valid for five years and they are mandated to quote registration number in every sale facilitated by them. Agents are also required to maintain and preserve prescribed books. If the agent fails to follow any of these, he is penalised with around 5% cost of the flat that he had facilitated,” Mr Bhimani added.

Talking about responsibility of buyers, Mr Bhimani said, “Under Section 19, buyer has to make payments as per the manner and time fixed in the agreement for sale. Any delay in payment of these charges can attract payment of interest. Buyer has to take physical possession within two months of issuance of occupancy certificate and also participate in formation of a legal entity like society, association of allottees, and co-operative society.”

Mr Shenoy, who works with the Consumer Guidance Cell of the Mumbai Grahak Panchayat, then explained the conciliation process under the RERA. He says, “Before RERA came into effect the affected buyers of real estates could only approach the civil courts, criminal courts or consumer forums under the provisions of the Maharashtra Ownership of Flats Act (MOFA) or the Consumer Protection Act 1986. These involved long years of pending cases for affected buyers in one of the above courts and very high legislation costs. At present thousands of cases are pending in various courts across Maharashtra.”

When the RERA was being enacted consumer organisations strongly advocated alternate dispute resolution mechanisms to help the affected buyers avoid the above hassles and get quick dispute resolution for the affected parties at low cost by cutting out the delays due to legal wrangles and legal costs. Accordingly, the Central government, while enacting the RERA, provided under Section 32 (g) a provision for amicable settlement of disputes.

“To meet the above obligation Maharashtra RERA (MahaRERA) has set up 10 conciliation benches in Mumbai and five in Pune. Each bench consists of a member each from real estate developers’ organisations and one member from a recognised consumer organisation. For the Mumbai and Pune benches National Real Estate Development Council (NAREDCO), Maharashtra Chamber of Housing Industry (MCHI) and Confederation of Real Estate Developers Association of India (CREDAI) are chosen as representing the developers and Mumbai Grahak Panchayat (MGP) has been chosen to represent consumers. Similar benches will be formed in other major cities of Maharashtra progressively based on need,” Mr Shenoy added.

The conciliation application process has started from 1 February 2018 and the first conciliation hearings have taken place both at Mumbai and Pune on 10 March 2018.

He expects more and more aggrieved persons will tend to use the conciliation mechanism as it is expected that the duration of the process of conciliation should not exceed 45 days and should be completed in maximum three hearings as, unlike what happens in normal courts, no adjournments are allowed for paltry reasons. He said, “Also as the cost is only Rs1000 it is quite affordable for a common man and no legal fees are involved. This is expected to reduce the number of pending cases in the courts.”