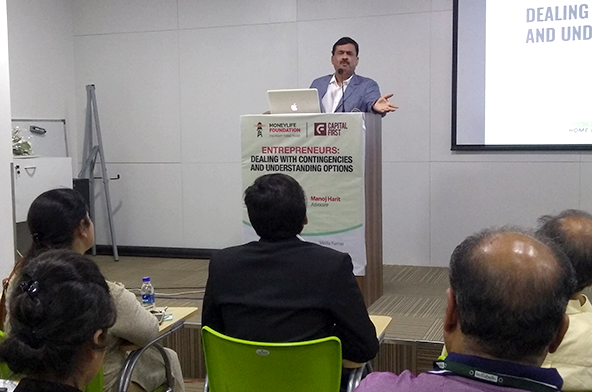

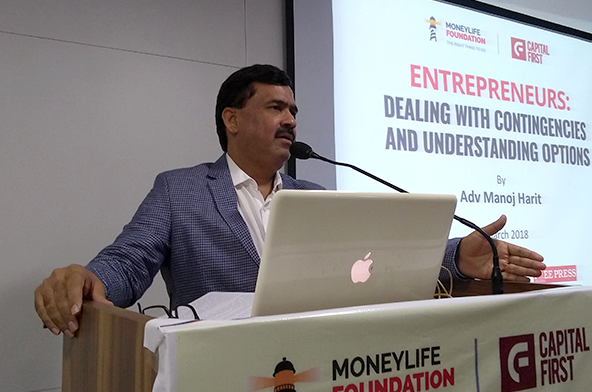

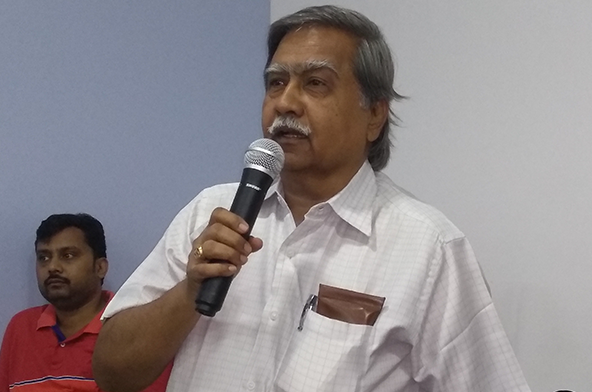

“Micro, small and medium enterprise (MSME) entrepreneurs are providing employment and generating revenues for everyone, including the government. Unfortunately, under financing at each stage, besides unacceptable practices followed by banks are the most significant reasons for failures of MSMEs that the government needs to address,” says Advocate Manoj Harit. He was speaking at a special seminar on “Entrepreneurs: Dealing with contingencies and understanding options”, organised by Moneylife Foundation and Capital First in Mumbai.

Adv Harit, who practises at the Bombay High Court, has specialised in helping businesses to deal with various recovery actions. Talking about handling credit crunch faced by entrepreneurs, he says, “Never borrow from private lenders during such times. Do not go for personal loans so that you can pump money in the business. Run a tight ship, cut down your expenditure. And most importantly never lose focus on profitability of your business.”

This unique seminar was aimed at empowering entrepreneurs with knowledge about their legal liabilities and various options to deal with financial difficulties.

Adv Harit explained fundamentals of industrial finance and its implications, what not to do during a credit crunch, or identify first signs of incipient sickness, what to do when faced with recovery proceedings and whether to revive or seek an honourable exit, and when entrepreneurs should make that decision.

“Small and medium entrepreneurs usually provide personal guarantees and even pledge their homes to pursue their dreams without understanding its legal consequences. However, banks provide loans only after due assessment. This means, after the loan is sanctioned, there is no need for an additional collateral like a personal guarantee or mortgage of home and other personal property,” he added.

Adv Harit is unique personality in having been an entrepreneur himself (he ran a textile unit) and is still engaged in horticulture at Malegaon while practising law in Mumbai.

Many times, entrepreneurs fail to understand first signs of sickness. There could be several reasons for this. “However, instead of taking corrective measures, they end up seeking more funding from banks. When bank asks for additional collateral, entrepreneurs sometimes end up with personal guarantees or even pledge homes. What is needed here is the entrepreneur should generate more revenues with same infrastructure or cut costs or expenses and thus reduce loss,” he added.

The Reserve Bank of India (RBI) says it is duty of the bank to identify sickness at the incipient stage and recommends that the lender should either restructure the debt, or rehabilitate the unit with additional finance, or take measure to nurse it until it comes out of sickness. (RBI Circular RPCD. No. PLNFS. BC. 88/ PS.72-91/92)

“There are master circulars, guidelines issued by regulators. But banks hardly follow this. For example, there is a deadline of 90 days after, which a debt turns into non-performing asset (NPA). However, the RBI says to count 90 days from end of the quarter in which the incident took place. Nobody follows this. In addition, on 8 February 2018, the Reserve Bank has issued a new circular extending the 90 day deadline to 180 days for MSMEs. Unfortunately, many MSME accounts are still being marked as NPAs based on earlier provisions and under recovery process,” Adv Harit said.

The Debt Recovery Tribunal (DRT) has a set procedure to handle recovery cases. Adv Harit said, “When an account becomes NPA, the lender issues notice under Section 13(2) of the Securitisation and Reconstruction of Financial Assets and Enforcement of Securities Interest (SARFAESI) Act. But many borrowers fail to understand and respond to this notice. Then when the lender issues a notice for recovery under Section 13(4), the borrower, runs to a lawyer for help. However, since the entrepreneur had failed to respond to first notice, it become difficult to defend later.”

Measures under Section 13(4) include symbolic possession, physical possession, takeover of management, appointment of an agent or manager, sale, and transfer of the asset after sale. The borrower can file appeal after 45 days before the DRT, but is should accompany with a written application giving sufficient cause to condone the delay. However, when an appeal is beyond the first chance of 45 days, the borrower loses a huge opportunity to contest with all valid grounds right from the inception of the recovery action.

“It is unfortunate that many borrowers fear of responding to the 13(2) notice or sometimes indulge in prolonged discussions with the Bank to resolve the matter by way of a onetime settlement,” Adv Harit says, adding, “the entire gamut of the SARFAESI Act is that the remedies provided to the borrower against the recovery measures invoked by the bank are within a time-frame and the Bank is vested with unilateral powers under the statute to initiate them without the intervention of any court. Hence, when the borrower is occupied in negotiations, the bank officer keeps looking at his calendar all the time and strikes taking the borrower off-guard by promising to enhance credit limit if he pays certain dues. The fate of the borrower’s case depends on how swiftly he responds to every measure or else the Bank will overpower him much before he even prepares for the contest.

In case the bank manipulates in such manner to take possession or sell the collateral asset without lawfully intimating the borrower then in such instance even if the borrower had approached the DRT belatedly beyond the prescribed limitation as above, then the only opportunity he could be heard is if he can prove the ‘fraud’ done by bank, which gives sufficient cause under Section 17 of the Limitation Act, 1963, he added.