Investors are always confused with the question whether they should invest directly through stocks or through an equity mutual fund. Debashis Basu, editor of Moneylife, at a Moneylife Foundation event on the topic, explained major differences between stocks and mutual funds, and also which one is suited to whom. Many people tend to avoid stocks as they are considered to be riskier than stocks and more attention needs to be paid to details.

“Though equity funds offer a diversified portfolio, in principle they as similar to holding individual stocks,” explained Mr Basu at the packed Moneylife Knowledge Centre. Both are volatile and can fall sharply leading to a loss of capital, he said.

If one has a huge corpus to invest, over a long period of time, mutual funds turn out to be more costly as compared to stocks. The reason being, in mutual fund you pay a fee, which is a percentage of the market value of the corpus. In the case of stocks, you need to pay fixed annual maintenance charges and one-time transaction charges, which work out to be a tiny percentage amount.

Those who have no time and interest to analyse individual stocks or those who have a low investment corpus should go for equity funds. Equity funds would be ideal for those who are just beginning to invest and are looking to invest small amounts. However, when they gain confidence and have larger corpus, they need to look at stocks because of higher costs in staying invested in funds.

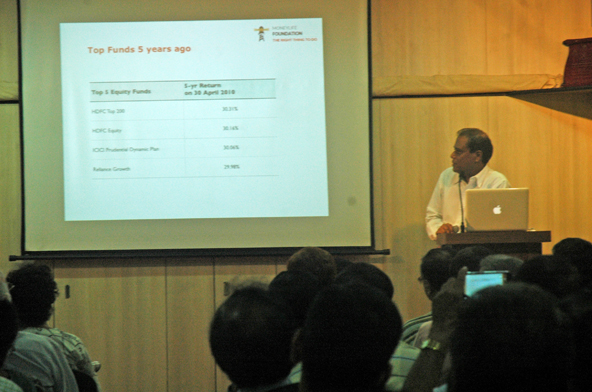

Illustrating this with charts, Mr Basu explained how stocks score over equity funds in terms of costs. “Costs eat in to an equity fund returns. Equity fund charge an expense ratio, which is their fees in terms of a percentage of the corpus they manage. This is deducted from the corpus on a daily basis. The fees charged can range between 1.25% and 3% per year.

In percentage terms, it may seem very low, but as your corpus grows, you are paying higher fees in percentage terms and the costs for holding stocks remains fixed and transactions costs are low as compared to equity funds,” he said.

In terms of stock selection too, equity funds are not very efficient, Mr Basu said, adding, they (funds) stick to the same basket of stocks and are heavily weighted to their benchmark stocks. Most equity funds also have similar stocks in their portfolio. Mr Basu gave an example how nearly 86 of the 200-odd actively managed schemes hold Reliance in their portfolio. The main reason for holding this stock is because it is a heavy weight on the index. To win at stock picking, Mr Basu said that one should pick stocks with high return on capital and hold them for the long term.