“The pool account of Karvy Stock Broking Ltd (Karvy) is nothing but a common account. If an investor has shares, which were purchased from Karvy as a broker, he would also have their contract notes. So, now instead of chasing and discussing Karvy’s pool account, the investor should work towards obtaining a statement of his own demat account or if a statement is not available, approach the relevant stock exchange with the contract notes in order to reclaim their shares,” advised Vishal Gajjar, assistant vice-president at the National Securities Depository Ltd (NSDL), while speaking at a webinar organised by Moneylife Foundation.

This webinar was part of the sustained efforts of Moneylife Foundation to act as a source of knowledge and guidance for investors of Karvy, Anugrah Stock & Broking Pvt Ltd (Anugrah) and other stock broking firms that have been declared defaulters. Amit Jindal, vice president at NSDL and his colleague Mr Gajjar, also answered several questions by investors present during the webinar.

Starting with a brief presentation, Mr Gajjar went over the timeline of how NSDL terminated the depository participant (DP) status of Karvy, after notice orders from the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), were followed by confirmatory orders from the Securities and Exchange Board of India (SEBI).

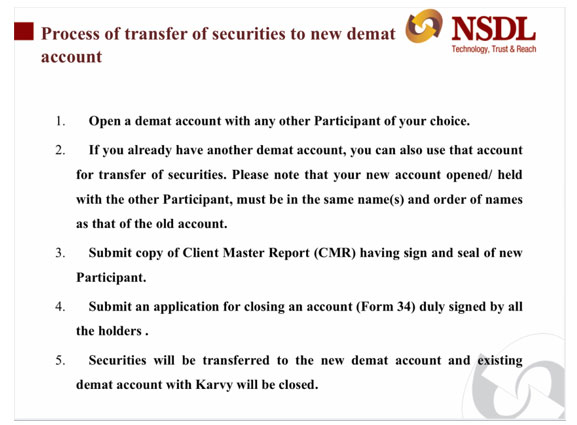

He then went on to explain in detail the process an investor of Karvy needs to follow, to transfer their securities to a new demat account, now that the DP status of Karvy had been terminated. The process, he explained, is essentially the same as that with CSDL, where an investor will first have to choose another DP to transfer their securities from Karvy. “Care has to be taken that a new demat account with a DP is opened in a single name, if the source account (with Karvy) was a single account and similarly it has to be a joint account, if the original Karvy account was also in a joint name,” Mr Gajjar added.

To start the process of transfer of securities, the investor then simply fills out a transfer form and submits the same with a client master report (CMR) which should be duly signed with a seal of the new participant. They would also have to submit an account closure form (Form 34), duly signed by all account-holders, Mr Gajjar said, adding that all relevant forms are readily available on the website of NSDL.

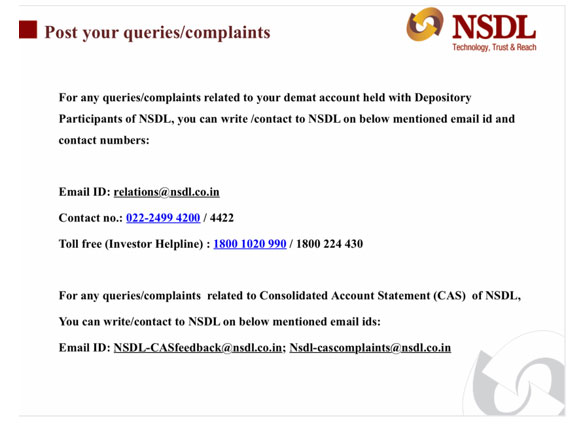

During the webinar, Mr Jindal also confirmed that NSDL was closely monitoring and following up with Karvy for closure of demat accounts and processing for pending closure or transfer requests. He said, “All queries and grievances received by NSDL are being resolved on a priority basis and if an investor has any query, they can surely write to NSDL at [email protected]”

Many investors present during the webinar were concerned about acquiring a statement of transactions from Karvy, now that they had shut down operations. Mr Jindal reassured such investors that, although Karvy had been declared a defaulter and was in the process of shutting down operations, they would still be available to assist investors with administrative work such as processing a request for a statement of transactions.

Mr Gajjar also pointed out the alternate methods that are available to investors saying, “You can also make use of NSDL’s IdeAS (internet-based demat account statement) portal, to view balances and all transaction details through the website or through the official mobile application. If all else fails or if you still face difficulty, you can always send an e-mail to [email protected].”

Although this webinar was organised at very short notice, it saw an attendance of over 170 people on Zoom and a few more watching it live on YouTube and Facebook. Both Mr Jindal and Mr Gajjar, took the time to patiently answer many of the queries that were raised during the webinar.

If you would like to receive such updates about the activities of Moneylife Foundation, you can become a member for FREE and get regular updates from our newsletters.

A video recording of the session is available on our YouTube Channel and can be viewed below: