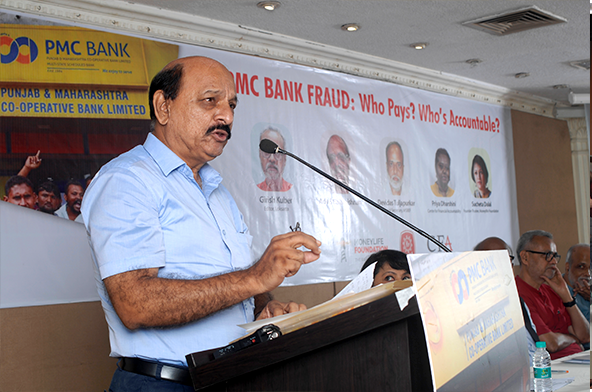

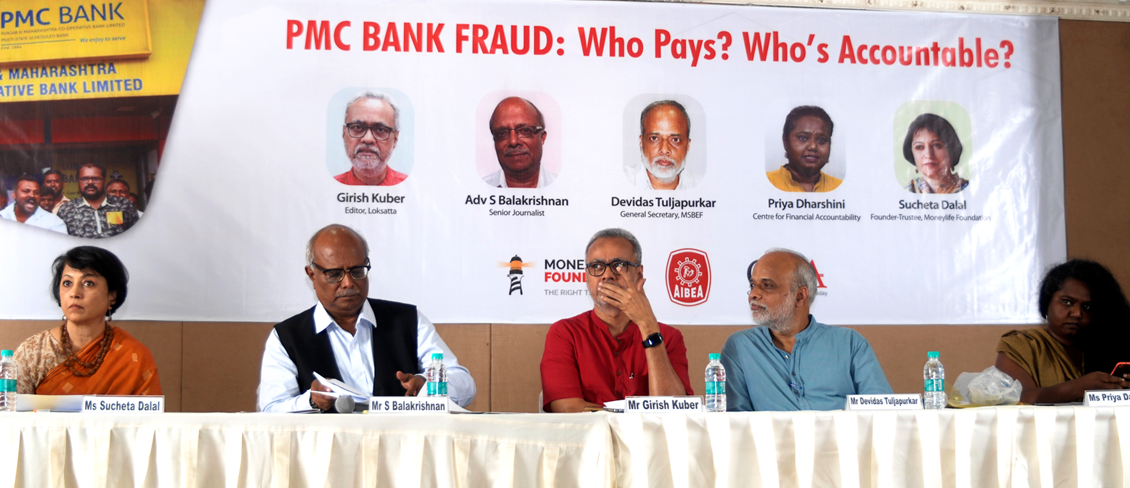

Justice for PMC Bank customers, was the collective voice of hundreds of depositors and customers of scam-hit Punjab & Maharashtra Co-operative (PMC) Bank and experts. Moneylife Foundation, along with All India Bank Employees Association (AIBEA) and Centre for Financial Accountability (CFA) had organised a public meeting to understand issues with PMC Bank and others, demand answers from the regulators and government and discuss the way forward.

The expert panel consisted Girish Kuber, Editor Loksatta, Advocate S Balakrishnan, who was Bureau Chief of Times of India, Devidas Tuljapurkar, General Secretary of Maharashtra State Bank Employees Federation (MSBEF) and Joint Secretary of AIBEA, Priya Dharshini- senior research associate with Centre for Financial Accountability (CFA) and Sucheta Dalal, Managing Editor of Moneylife and Founder-Trustee of Moneylife Foundation.

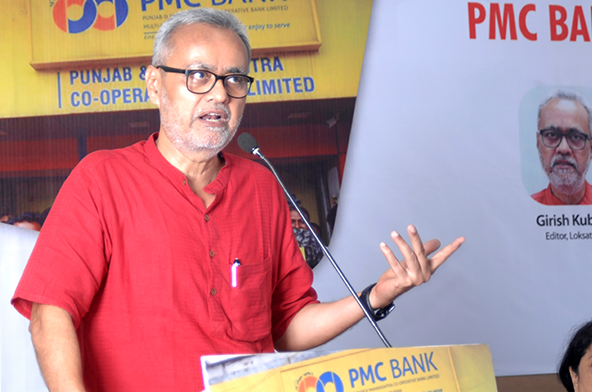

Initiating the discussion, Mr Girish Kuber touched upon the urgent need to have a fool-proof mechanism to control and regulate the banking system. He cited an old joke to highlight the recent series of frauds in banks, Robbery is a job of amateurs. Professionals set up a bank.

The dual regulation for co-operative banks ends up with the co-operative banks getting a step motherly treatment from everyone. It is a sad state of affairs and with all the political connections associated the bank, regulation often has to wait till elections are over.

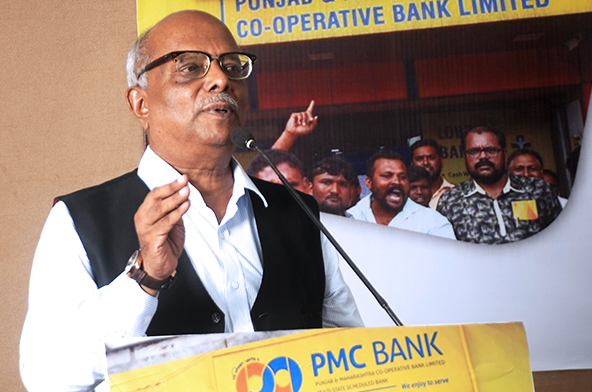

According to Advocate S Balakrishnan, the RBI needs to act with transparency and must be made accountable for the current co-operative bank imbroglio.

He said that he finds it extremely disturbing that the dice is heavily loaded against the common man. Middle class people end up paying a heavy price for all these scams.

It is extremely worrying that depositors across co-operative banks are panicking about their hard earned money and there is an urgent need for a sustained unified joint effort to take on the RBI, he said. He called on all the aggrieved people to join forces and file a writ petition.

He added disappointedly The RBI is the watchdog but its response after the fraud came to light, has been vague and non-commital . He called for an urgent detailed forensic audit of the RBI itself, given that the central bank functions in the most opaque manner .

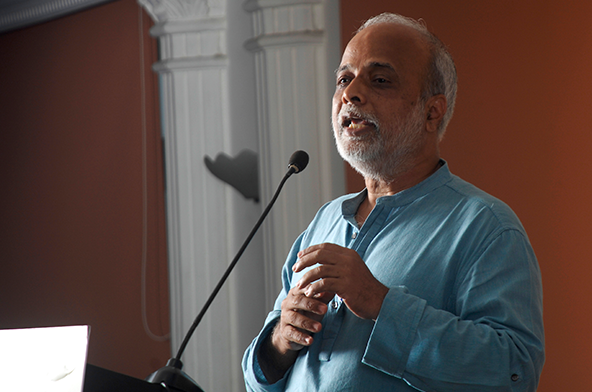

Mr Tuljapurkar, who as a whistle blower in Bank of Maharashtra (BoM), has exposed fraud in BoM in the past, feels that in the current atmosphere it would be wrong to only speak about the PMC bank case in isolation.

He said that despite regular audits, inspection and concurrent audits, banks regularly end up in defrauded. The system is rotten and if we need to fix the system then we need to fight unitedly.

Priya Dharshini from CFA said that the problem is not specific to the PMC bank. The nature of the regulator institution has been changing in the last few years. Protecting depositors money now ranks far lower in the RBI s priority list.

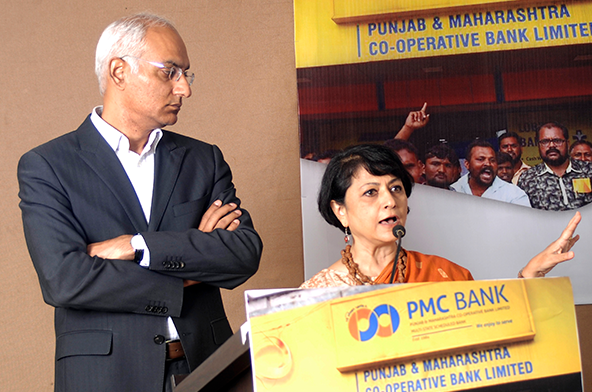

Ms Dalal said that one co-operative bank fails every 2-3 months. There are more than 1500 co-operative banks. Hence bailouts cannot work for all banks. It has already been 18 days and a takeover might still be possible. But any future buyer needs to have a very clear picture of the status of PMC Bank. The buck stops at RBI and we need official answers. The window of opportunity is very small and we need to build up the pressure and look for solutions to resolve the impasse.

Several prominent citizens, activists, entrepreneurs and lawyers were also present for the meeting.

Participating in the discussion, Murali Neelakantan, who is former global general counsel of Cipla and former senior partner of Khaitan & Co, said that the only thing that could make an impact would be if even 1% of the 300,000 depositors (3000 people) come together and file a writ petition.

We have put together a legal team, two senior counsels from the Supreme Court who are wiling to come and help fight this legal battle.

It can only work if each aggrieved person attending this discussion comes and attends the court hearing. Even if a few thousand depositors come and attend the court hearing, it will build huge pressure on the court. He also explained the difference in strategy: filing a PIL vs filing a writ petition.

Z. B Inamdar who was working for Bombay Merchantile bank since 1986, shared his personal experience as a banker and a whistleblower. The number of people coming forward to file the writ petition would play a major role in building up pressure.

If you want to be part of the legal process, please fill up this survey and get in touch with us. Email: [email protected] or Whatsapp: +91-704-515-6415

Moneylife Foundation

304, 3rd Floor, Hind Service Industries Premises, Off Veer Savarkar Marg, Shivaji Park,

Dadar (W), Mumbai 400 028. Landmark: Chaityabhoomi lane.

Contact: +91 22 49205000