Moneylife Foundation conducted a special workshop for senior citizens on planning their finances after retirement. The first session on ‘Safe Investing and how not to lose money’ was conducted by Sucheta Dalal, managing editor of Moneylife and founder trustee of Moneylife Foundation. The second session on ‘Smart Investing’ was addressed by Debashis Basu, editor and founder trustee of Moneylife Foundation.

“80 is the new 60. Seniors are fitter and more active. It is a great time if you plan well and work at being connected,” said Ms Dalal. But India is low in Human Development Index ranking which suggests scarce geriatric care, poor infrastructure, inadequate regulation and slow and expensive judiciary in our country. There are 100 million seniors in India who are struggling, she said.

She made the audience aware about the most common misconception about financial products. People relate financial products with consumer products because they are not hard-wired to understand the nitty-gritties of the financial world. Ms Dalal shared an important concept called cognitive Impairment. It says that seniors are more susceptible to fraud and are easily targeted by sales agents. This was supported by research figures from, US Federal Trade commission – 80% of scam victims in US are above 65 years of age. Elder financial abuse costs US senior citizens more than $2.6 billion a year says MetLife Mature Market Institute.

She said that senior citizens should avoid unregulated offers like plantation schemes and art funds. They should only invest in schemes by SEBI, IRDA, PFRDA and RBI. She also explained about the scarcity of good health insurance policies in the market catering specifically to senior citizens. Participants took a keen interest in phishing, vishing and identity traps which are rampant online these days. She asked them to keep all conversations with banks documented, store phone numbers and email IDs of relationship managers and managers, at least two levels above them.

She said that one has to be careful to select a bank. Government banks are safe and cooperative banks are under dual regulations – RBI and Department of Cooperative Societies. Neither of them regulate properly. She gave a few banking tips to the participants about how to keep their money safe. She shared a story about a 79-year old man Mangelal Sharma, who was cheated by IndusInd Bank, which Moneylife has written about.

Ms Dalal explained that people don’t know about the difference between insurance and investment, therefore they trust agents, who insist that they buy policies in the name of their children or grandchildren. She told the audience about various cases that have come to the Foundation involving forged signatures, fake ID proofs and fake witnesses.

At the end of her session, she gave examples of why nomination is important and why one should keep it updated. She highlighted how forgotten nominations are harmful and how assets land up in the hands of unworthy relatives and acquaintances. She also made the participants aware about legal protection they get under Maintenance and Welfare of Parents and Senior Citizens Act, 2007 (in December 2007). Monthly maintenance, faster complaint disposal and levying fines, if children do not take care of them are all covered under the Act, Ms Dalal emphasised

In the second session, Mr Basu explained retirement planning which can be very complicated. There are hundreds of financial products available. Along with this, the concerns of investors differ from before retirement stage to post-retirement stage. A retired individual would be more interested to know about where to put the corpus, expected return from corpus, tax implications, how long the savings will last, how much and when to withdraw from principal etc.

Post-retirement, one’s main focus is to protect the corpus but one should also grow the corpus because people are living longer. Here, people have the option of immediate annuities, Senior Citizens Savings Scheme (SCSS) and MIP schemes, but none of these are great choices, said Mr Basu. He explained that Senior Citizens Savings Scheme (SCSS) is a better option than Annuities as it pays a higher rate but both are taxed according to your income tax bracket.

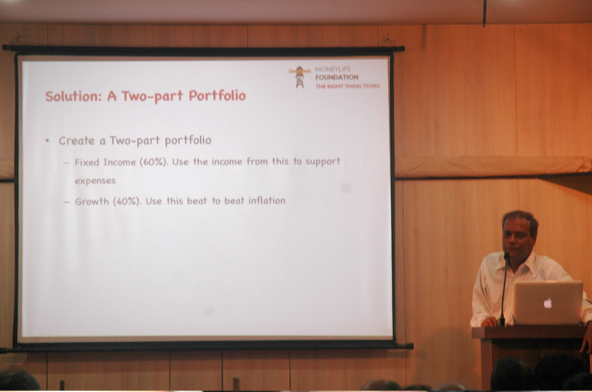

Mr Basu then moved on to a fictional scenario, which spanned from the pre-retirement stage to the post-retirement stage, to help participants understand how to formulate a plan. For those who have retired, Mr Basu advised the audience to create a two-part portfolio. One could contain 60% of the total corpus to be invested in fixed income securities such as bank fixed deposits, corporate fixed deposits, short-term debt funds and bonds. And the second, containing 40% of the total corpus could be invested in diversified equity mutual funds, which would work towards beating inflation. He illustrated two plans with an example, 1. Where he took an initial corpus of Rs25 lakh over a 20-year period. 2. Where investment increases 2% for the same period. In the latter case, money grows by 45% more. Both the plans were depicted through graphs and charts for better understanding of the participants.

For the fixed income part, based on their individual tax-bracket, one can invest in a mix of banks FDs, corporate FDs, corporate bonds or non-convertible debentures, tax-free bonds and short-term debt funds. The different investment options needs to be evaluated for parameters such as safety, ease of investment, post-tax returns, liquidity and interest payment options. Each investment option was discussed in detail for its advantages and disadvantages. You can’t get best of everything in one instrument and hence there are good reasons to understand all the options and allocate your money in different options based on your risk appetite, Mr Basu pointed out.

For those in 20% and especially 30% tax bracket an excellent option is listed tax-free bonds from government companies.

You have the option for long-term investment as the bond terms are 10, 15 years. He also made the audience aware about reverse mortgage procedures and issues in India. The presentations were followed by lively interactive discussions.