A Poor Widow Overcame Hardships to Claim Legal Heirship of Property, but Battles On

Elizabeth Dias is a 54-year-old widow, a mother of two sons and earns a living by cleaning flats and office premises for a meagre Rs6,000 per month.

She's the prime earner in their family. Her husband Anthony, was a daily wage earner who climbed coconut trees for a living and had an, unfortunately, fatal fall from one nearly a decade ago. Her elder son is mentally challenged, while the younger one is her primary support and is a government-certified football coach.

Her extraordinary and gritty battle for a roof over her head is a lesson for educated people who have far more resources and contacts, and the same free guidance given to her is also available to them from Moneylife Foundation and its expert adviser Shirish Shanbhag. Here is her story.

Until recently, Elizabeth and her family resided in a pagdi building in Dadar, Mumbai, which requires payment of a hefty deposit for almost permanent residence rights. She moved into this accommodation belonging to her in-laws soon after her marriage. They have now passed away. The rental agreement for the room was between her father-in-law and the owner, but the lease was legally transferred in Anthony's name after his death. Legally, this means that if the chawl undergoes redevelopment, a free flat would have to be allotted to Anthony since he was a lessee in the pagdi building.

It so happens that in the year 2000, the owners of the pagdi chawl sold the property to a builder named West Avenue Realtors Pvt Ltd. Since this was a cessed chawl (where the occupants pay a cess or tax, which is actually a repair fund), the builder with permission from Maharashtra Housing and Area Development Authority (MHADA), prepared a list of lessees in the chawl who would be allocated a flat free of charge, in the newly constructed building. Anthony was also allotted a flat but unfortunately expired before the formalities of registering a formal agreement could be completed.

It was around this time, that trouble started brewing for Elizabeth. She has two brothers-in-law; one is married with a family and the other a bachelor, both having menial jobs but well settled in their ancestral Goan home.

When the brothers heard about the builder allotting a flat to the now-deceased Anthony (which would legally be transferred to his wife, Elizabeth), they felt aggrieved and filed a complaint from Goa, insisting that they be added in the list of lessees. They claimed that Elizabeth had no rights to the flat, as they were the rightful legal heirs of their parent's flat.

How valid was their claim? In this case, the building being a pagdi arrangement, free flats of a redeveloped building on the same land can only be allotted to tenants who had a valid tenancy agreement with the owner. Here, the original tenants were Elizabeth's parents-in-law, but after their passing, the lease was transferred to their son (Anthony), who resided in the same premises. Anthony's brothers did not live in the same chawl, so transferring the tenancy to them was never an option.

Realising it could be a messy family matter, the builder asked both brothers to approach MHADA for addition of their names in the list of lessees. They travelled to Mumbai and met officials in MHADA, submitting their old ration cards as proof of residency and tenancy in the pagdi chawl. This was rightfully rejected by MHADA, as a ration card is not acceptable proof for tenancy in a pagdi flat. However, the brothers were not about to give up the matter so easily. In the coming years after the building was constructed, they continued to harass Elizabeth in new ways.

In 2004, the newly constructed building was registered as a cooperative housing society (CHS). The managing committee of this new society, initiated the process of handing over share certificates to the lessees who were promised free flats. Unfortunately, while Anthony Dias has been established as a lawful tenant in the pagdi building, he had expired before he could complete the necessary registration of his newly allotted flat. The 'Agreement of Alternate and Permanent Accommodation' had not been registered with the sub-registrar of assurances and, hence, the managing committee refused to give a share certificate to Elizabeth.

Since Anthony was the lessee, the agreement had to be signed and registered by him. Had this agreement been in place before his untimely death, matters would have been simpler for Elizabeth. As it was, the managing committee refused to budge and asked her to first procure a no-objection certificate (NOC) from the brothers. Up until this point, Elizabeth was being helped by a social worker from her Church, named Robert Lewis.

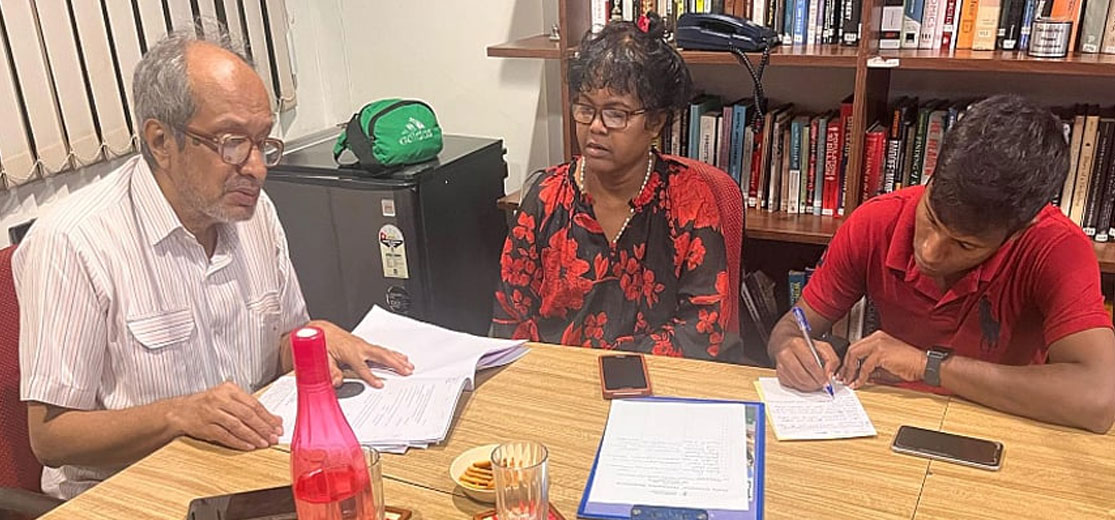

When matters started getting too complex for Robert, he referred Elizabeth to Moneylife Foundation and Mr Shanbhag. As Mr Shanbhag explained to Elizabeth that, since the brothers had never resided in the flat, their name was not legally eligible for allotment, there was no question of getting a NOC from them.

At this point, the brothers appointed a lawyer and filed a writ petition at the testamentary division of Bombay High Court, requesting that their names be added to the lessee list, as they were legal heirs and the tenancy (and also the subsequent new flat) should legally be transferred to them.

It is important to note, that the brothers had permanent residency in Goa and were doing much better financially than Elizabeth. On the other hand, Elizabeth had only a few years of formal education (up to 4th standard) and did not have the financial resources to hire the services of a lawyer or to bear expensive court fees. With Mr Shanbhag's advice and the help of a social worker from her Church, Robert Lewis, she decided to defend her position at the testamentary division by herself.

Thankfully, the officials at the Bombay High Court agreed to her plea and passed an order directing the managing committee of the housing society to transfer Anthony's flat in Elizabeth's name. They also stipulated that it should be completed within a month and that the court should be appropriately informed of the same.

One would think, that Elizabeth's troubles were finally over and she could comfortably receive the share certificate of the new flat in her name, formalising the agreement. But as fate would have it, the managing committee in direct contravention of the court's order, issued the share certificate in the name of the original tenant/owner, Anthony Dias and not in Elizabeth's name. Once again, she took the guidance of Mr Shanbhag and filed a complaint with the deputy registrar of cooperative societies, located in Fort area of Mumbai, for not following an official order passed by the testamentary division of the Bombay High Court.

In the meantime, the brothers had not given up the fight and hired another advocate to put in a request to the divisional joint registrar (in Fort, Mumbai) that their names be added in the share certificate. Elizabeth was not about to give up either.

With guidance from Mr Shanbhag, and support from Robert, she defended her position at the divisional joint registrar's hearing. Making her arguments in broken English, she managed to convince the officer concerned to pass an order in her favour. However, the managing committee still refused to comply with the order from the divisional joint registrar and did not issue a share certificate to Elizabeth!

She then filed a fresh complaint with the divisional joint registrar about the society disobeying its order and having failed to implement it in a reasonable time.

In a major development, the registrar's office responded to her complaint and dissolved the society's managing committee and appointed an authorised officer (earlier referred to as the administrator) in its place.

Elizabeth then approached the builder, West Avenue Realtors, to make an official alternate and permanent accommodation' agreement. This was the only document pending, which would officially confirm Elizabeth as the owner of the flat allotted to her deceased husband. West Avenue Realtors also agreed to complete Elizabeth's accommodation agreement and asked her to produce an NOC from the society.

But there is another twist in the tale. The authorised officer of managing the society now began to create issues. He claims that Elizabeth has unpaid maintenance dues of Rs1.4 lakh, which she needs to clear before a NOC can be issued. Fearing that she would lose her flat on this count, she approached Mr Shanbhag for assistance again.

As recently as last week, Mr Shanbhag after examining the maintenance bills in detail, was able to reveal that they were incorrectly calculated from the date the society was formed in 2004, at a time when Elizabeth was not in possession of said flat. Other unnecessary charges, such as 4-wheeler parking, had been added. Elizabeth now hopes to prove that all monthly maintenance dues have been paid through a cheque in each case by presenting her bank statements.

When the matter of unpaid maintenance dues is finally resolved, the authorised officer will issue a NOC for her flat's 'alternate and permanent accommodation' agreement. Mr Shanbhag has also helped her draft a request to West Avenue Realtors to add the names of her two sons in the agreement so that there no future disputes on legal heirship. So she is near the finishing line, but not quite there as yet!

It's a shame that a rightful heir to a property has to undergo such trials and tribulations for years and sometimes even decades, for something that legally belongs to them. After fighting hardships at every stage, armed only with her self-determination and the courage to fight for her rights, Elizabeth will now finally be the rightful legal owner of the flat which was allotted to her deceased husband.

Moneylife Foundation organises free weekly counseling sessions on matters related to cooperative housing societies, insurance, banking, mediclaim, right to information and other issues. These sessions are intended to help those who are unable to navigate the often cumbersome and convoluted path of grievance redress for various issues in India. The Foundation also runs an online helpline to assist those who cannot attend physical counselling sessions.

If you would like to consult Mr Shirish Shanbhag for any property or housing society-related matter, please call (022) 24441058 or (022) 24441059 for an appointment. Mr Shanbhag conducts counseling sessions every Thursday between 3-6pm at Moneylife Foundation's office in Mumbai.