Ministry asks SFIO to look into Helios & Matheson; ROC in 3 other cases

Acting as a mere post office, the Ministry of Corporate Affairs (MCA) forwarded a Memorandum from Moneylife Foundation highlighting the plight of over 1,138 aggrieved investors in corporate fixed deposits (FDs) to the Serious Frauds Investigation Office (SFIO), as well as, to its regional offices for further probe, reveals a reply received under the Right to Information (RTI) Act. The Moneylife Foundation compendium represented an analysis of 1,596 complaints, which was sent along with the names, details and numbers of investors, mainly senior citizens, who have been cheated by these companies.

Unfortunately, the MCAs attitude reeks of utter callousness. Nobody from the Ministry bothered to respond to Moneylife Foundation's Memorandum, although it was sent to the Minister as well as Secretary in-Charge. It is only when we followed it up by filing an RTI application we got responses from the Ministry. This means that the battle for investors is far from over. Affected investors or Moneylife Foundation will now have to pursue the matter with SFIO and the regional offices to keep up the pressure and ensure there is some action.

Here is what the MCA has informed us through various RTI responses. On 8 April 2016, a letter to Moneylife Foundation told us that the complaint and memorandum has been forwarded to SFIO "for necessary examination and incorporation of findings thereof in investigation report". However, the note attached to it indicates that the action is with regard to Chennai-based Helios and Matheson Information Technologies Ltd (H&M). A note put up by the joint director for instructions says, "It is alleged that the subject company is cheating people by collecting fixed deposits from them u/s 58A of the Companies Act".

In January 2016, the Madras High Court ordered the liquidation of H&M and appointed an official liquidator. The hard-hitting Court order noted that the company had siphoned off funds, 'appears unreliable' and 'cannot be believed any further'. The HC had also directed an investigation by the SFIO in this case. However, the company had obtained a stay on the matter.

Separately, the MCA had forwarded complaints against three other companies to its regional offices, where the head offices of these companies are located. This includes Jaiprakash Associates (forwarded to ROC, Kanpur), Unitech Ltd (to Regional Director for North Region) and Plethico Pharmaceuticals Ltd (to Regional Director for North West Region). There is no information available yet on two other companies that formed part of our memorandum, namely, Elder Pharmaceuticals and Bilcare Ltd. Interestingly, complaints about both these companies and others in our list continue to pour in from hapless investors.

In the Jaiprakash Associates case, the same letter also includes one complaint forward by the Prime Minister's Office (PMO) with regard to the company as well as BL Kashyap & Sons Ltd. In this case, however, Anshu Tandon, Assistant Director, MCA, has asked for a report on the violation in 30 days. This letter is dated 4 April 2016. Significantly, in the case of Unitech, forwarded by us, the same Mr Tandon merely says, "advise you to direct to inspection officer to examine complaint during course of inspection". Clearly, there is no plan to hurry up or focus on quicker redress.

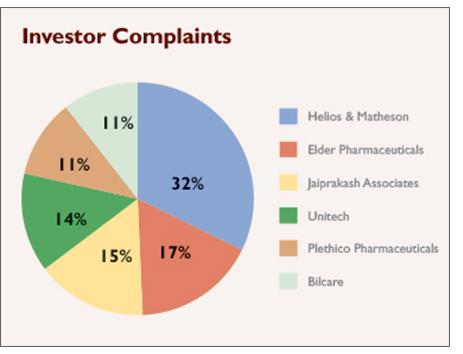

Moneylife Foundation's compilation showed that H&M accounts for the largest number of complaints. Besides H&M, companies, which have a large number of complaints are: Elder Pharmaceuticals, Jaypee Group, Unitech, Plethico Pharmaceuticals and Bilcare Ltd. The other companies were: Neesa Leisure, Phadnis Infrastructure, Micro Technologies, Jaypee Infratech, Yash Birla group of companies and Omnitech Infosolutions.

Moneylife Foundation's compilation showed that H&M accounts for the largest number of complaints. Besides H&M, companies, which have a large number of complaints are: Elder Pharmaceuticals, Jaypee Group, Unitech, Plethico Pharmaceuticals and Bilcare Ltd. The other companies were: Neesa Leisure, Phadnis Infrastructure, Micro Technologies, Jaypee Infratech, Yash Birla group of companies and Omnitech Infosolutions. The survey found that a majority of the aggrieved depositors choose to complain to the company itself, which is pointless. The Company Law Board (CLB), MCA, economic offences wing (EOW) and the Securities & Exchange Board of India (SEBI) are the regulatory agencies with whom they should seek to get their grievance redressed.

The survey found that a mere 2% of the complaints made to the companies were redressed. A whopping 83% were unresolved, while others did not complain. Repeated phone calls, e-mails and sometimes even personal visits and pleading to these companies have not yielded any results. Many companies and their officers do not revert to the depositors. Some of the companies give repeated extensions for the due date of principal and interest, but they are not repaid even after the extension date elapses.

Based on the findings from the Survey, Moneylife Foundation sent a Memorandum to Arun Jaitley, the Minister of Finance and Corporate Affairs. Below is the copy of the Memorandum...

You may also want to read…

Based on feedback and response from scores of citizens to our earlier survey on corporate FDs, Moneylife Foundation is looking at the feasibility of filing a class action for non-payment of fixed deposits. A dispute before the National Consumer Disputes Redressal Commission (NCDRC) requires the dispute value to be above Rs one crore. For starters, we are collecting data for SIX companies mentioned above.